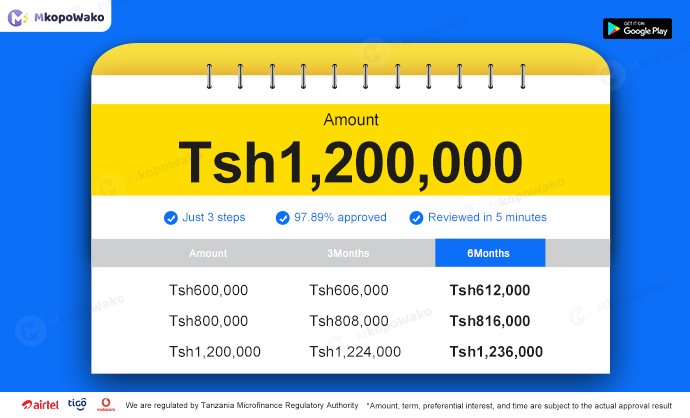

In order to apply for an unsecured fast loan, you need to provide specific documents and information to the lender. This process may vary depending on the financial institution or lending platform you choose. Generally, unsecured loans do not require