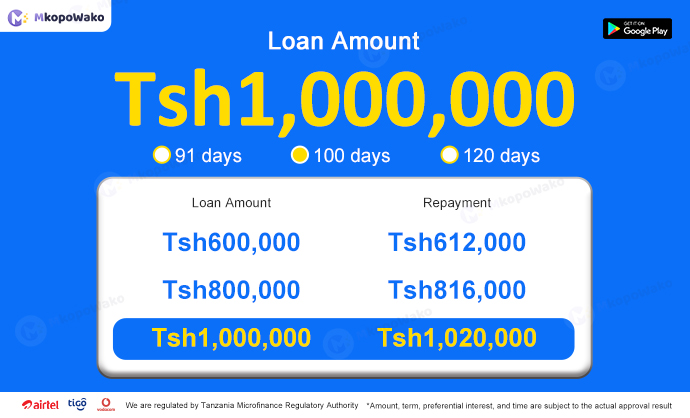

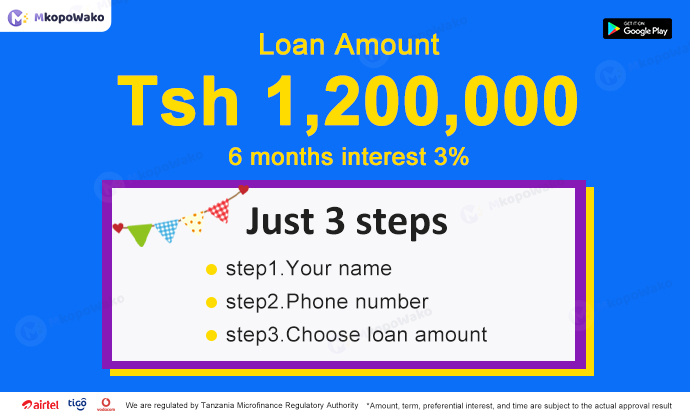

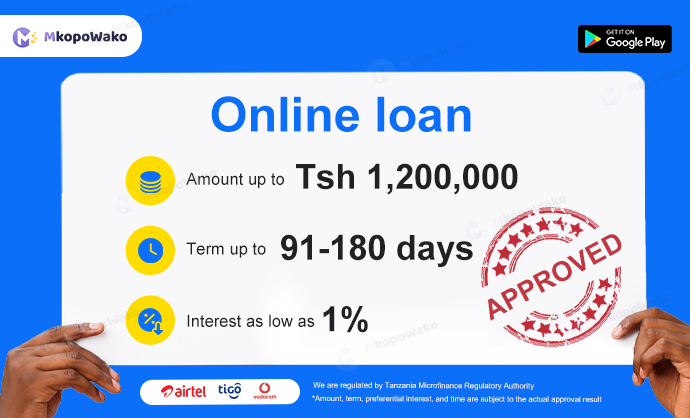

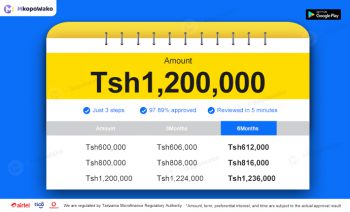

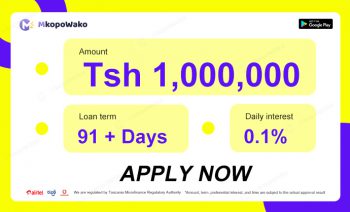

Unsecured Quick Loans are a flexible and convenient way to borrow money, providing a convenient solution for individuals and businesses in need of emergency funds. This type of loan is suitable for many different groups of people, including those with