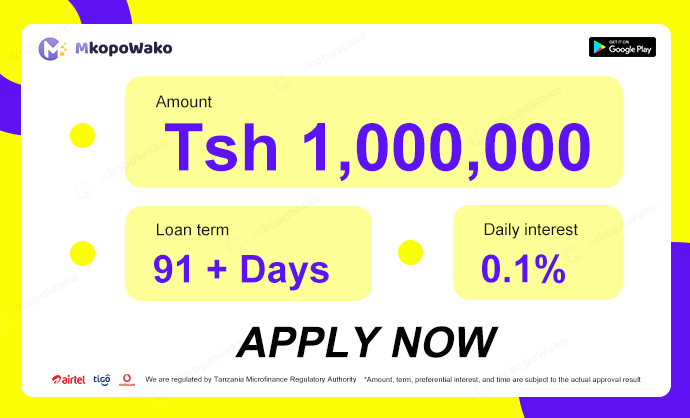

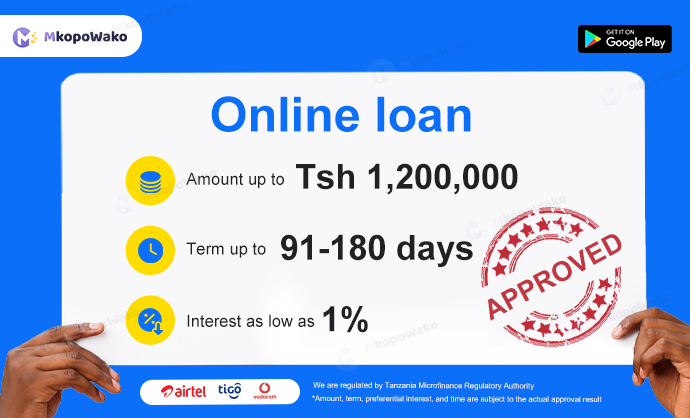

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

The interest rate for unsecured quick loans varies depending on the lender and the borrower’s creditworthiness. In general, unsecured quick loans tend to have higher interest rates compared to secured loans due to the lack of collateral. These loans provide

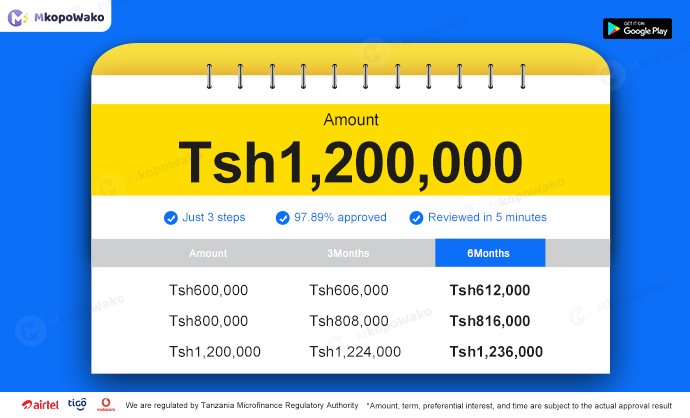

Tanzania is a country in East Africa that offers various options for borrowers seeking online loans. If you are considering borrowing 1 million Tanzanian shillings, it is important to understand the different repayment options available to you. This article will

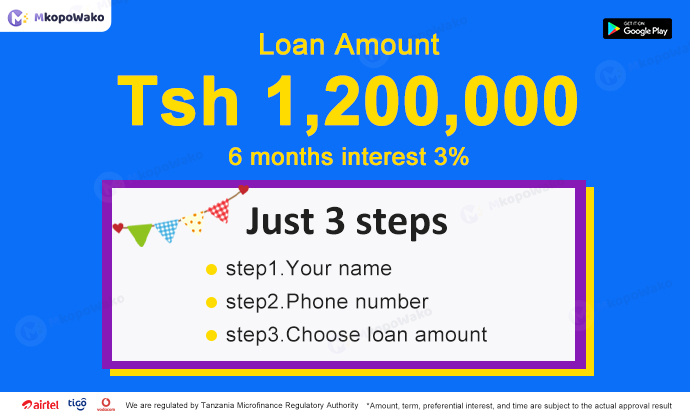

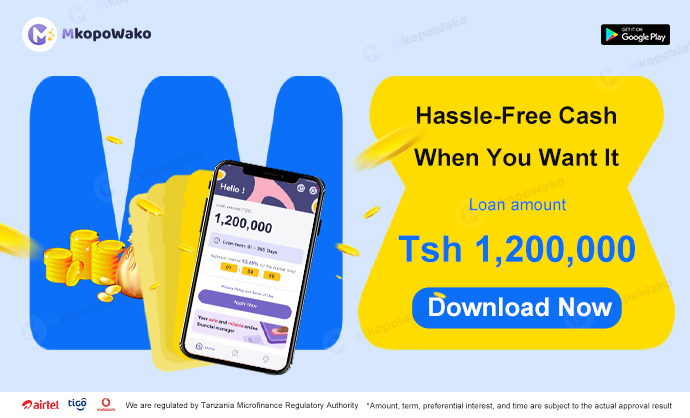

With the advancement of technology, accessing financial services has become easier than ever. In Tanzania, online loans have gained popularity as a convenient way to meet financial needs. Whether you need funds for personal reasons or business purposes, applying for

When it comes to applying for a loan, one of the key factors that individuals often consider is the processing time. Understanding how long it takes for a loan application to be processed is crucial for planning and managing financial

In the process of applying for a loan, common mistakes can lead to the application being rejected or delayed. Understanding these common errors and avoiding making the same mistakes in your loan application can help you successfully obtain a loan.

In today’s digital age, applying for a loan online has become a convenient and streamlined process. Whether you need funds for unexpected expenses, a home renovation project, or debt consolidation, online loans offer a quick solution with easy access to

Once you have successfully applied for an online loan and been approved, the next steps are critical. Knowing what to do next will help ensure you handle your borrowing correctly and avoid possible problems. From how to receive funds to

In today’s digital age, applying for a loan online has become a convenient and common practice. However, the success of your loan application depends on various factors that can impact the approval decision. To improve your chances of getting approved

In today’s fast-paced world, people are increasingly turning to online loan applications for their convenience and speed. However, with the rise of cybercrime and data breaches, it is crucial to ensure that these loan applications are secure and protect the

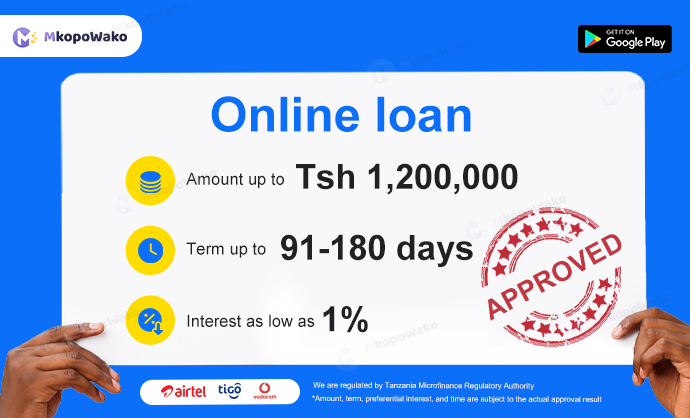

Getting a loan used to be a lengthy and cumbersome process, but with the rise of online lending platforms, borrowers now have access to fast and convenient loan approval. In Tanzania, online loans have gained popularity due to their quick

Tanzania’s financial sector has seen significant growth in recent years, with the rise of digital banking and online lending platforms providing more options for borrowers. Online lending has become particularly popular, as it allows borrowers to access funds quickly and

Online personal loans are becoming increasingly popular in Tanzania, as they offer a convenient and quick way to access funds. However, before taking out a loan, it is important to understand how the interest rates are calculated. The Annual Percentage

In recent years, online personal loans have gained popularity as a convenient and accessible way to obtain quick funds. However, when applying for an online personal loan in Tanzania, many individuals wonder whether a guarantor is required. In this article,

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status