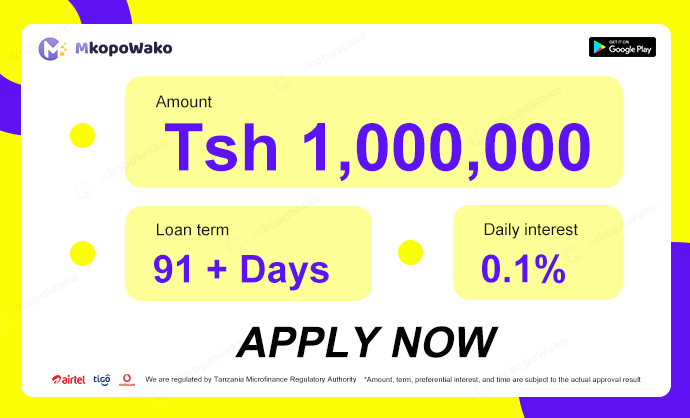

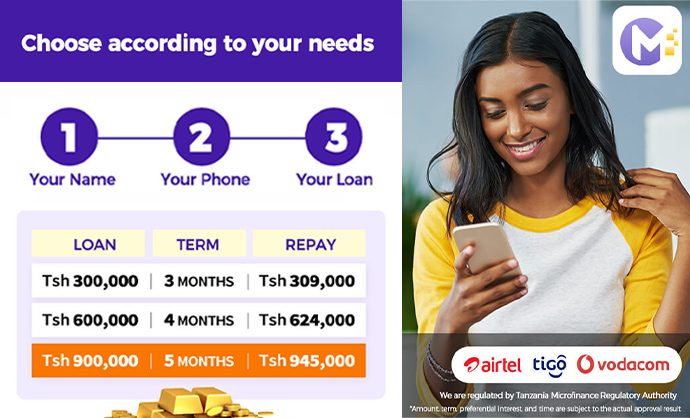

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

The interest rate for unsecured quick loans varies depending on the lender and the borrower’s creditworthiness. In general, unsecured quick loans tend to have higher interest rates compared to secured loans due to the lack of collateral. These loans provide

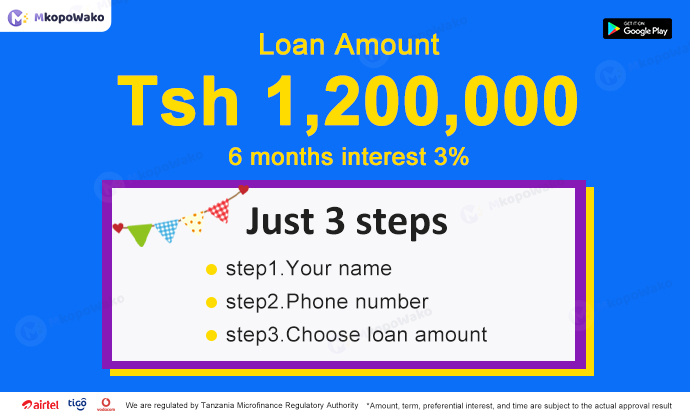

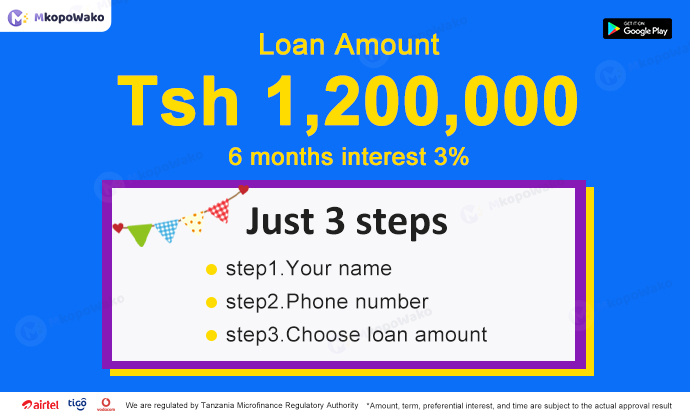

When it comes to securing a loan of one million Tanzanian shillings online, many individuals may wonder about the approval process and how long it will take. Understanding the intricacies and timeline of the approval process for such a substantial

With the advancement of technology, accessing financial services has become easier than ever. In Tanzania, online loans have gained popularity as a convenient way to meet financial needs. Whether you need funds for personal reasons or business purposes, applying for

When it comes to applying for a loan, one of the key factors that individuals often consider is the processing time. Understanding how long it takes for a loan application to be processed is crucial for planning and managing financial

Securing a loan is a crucial step in achieving financial goals, whether it’s for purchasing a home, starting a business, or funding higher education. Once you’ve submitted your loan application, it’s natural to wonder about its status and the next

In today’s digital age, applying for a loan online has become a convenient and streamlined process. Whether you need funds for unexpected expenses, a home renovation project, or debt consolidation, online loans offer a quick solution with easy access to

In today’s digital age, applying for a loan online has become a convenient and popular option. However, with so many loan products available, it can be overwhelming to choose the right one for your needs. This article will provide a

With the rapid development of the Internet, online loans have become more and more popular. Compared with traditional bank loans, online loans have the advantages of convenience, fast approval, and flexible repayment terms. In this article, we will introduce several

In today’s digital age, the option to apply for loans online has become increasingly popular. This convenient method offers a range of advantages and disadvantages worth considering. In this article, we will delve into the details of online loan applications,

Loan is a form of financial support that many people need in life. It can help individuals achieve various goals and cope with emergencies. Applying for an online personal loan is also a common way in Tanzania. However, to successfully

In today’s digital age, accessing financial services online has become more convenient than ever. In Tanzania, individuals in need of personal loans can now apply for them through various online platforms. This article will provide a comprehensive guide on how

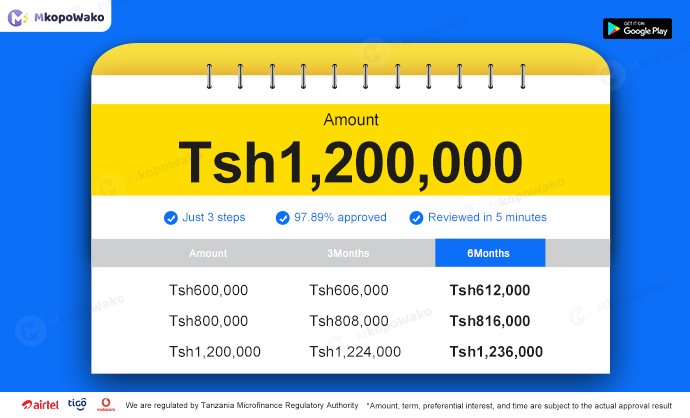

In Tanzania, what is the repayment period for online personal loans? Let’s delve into this topic and explore the ins and outs of the repayment terms for personal loans obtained through online platforms in Tanzania. Understanding Online Personal Loans in

In Tanzania, online personal loans have become increasingly popular due to their convenience and accessibility. Individuals looking to secure financial assistance can now do so through various online platforms offering personal loans. One key factor that borrowers often consider is

Understand the advantages of online loans With the continuous development of technology, loans have become more convenient, and we no longer need to go to banks or other financial institutions to apply for loans in person. Especially in Tanzania, it

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status