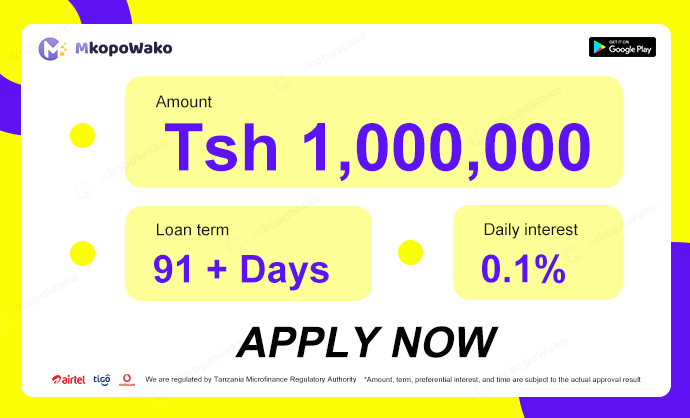

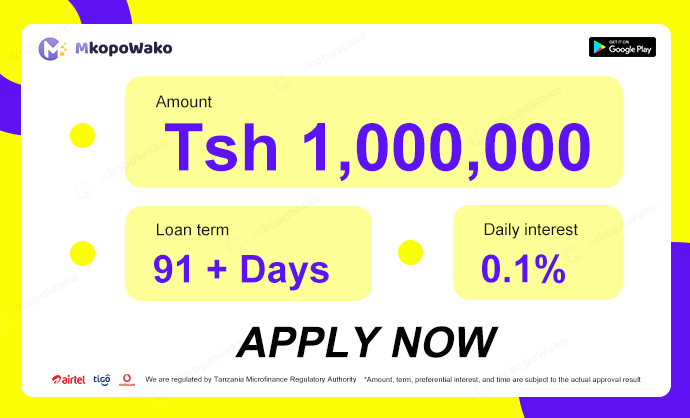

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

The interest rate for unsecured quick loans varies depending on the lender and the borrower’s creditworthiness. In general, unsecured quick loans tend to have higher interest rates compared to secured loans due to the lack of collateral. These loans provide

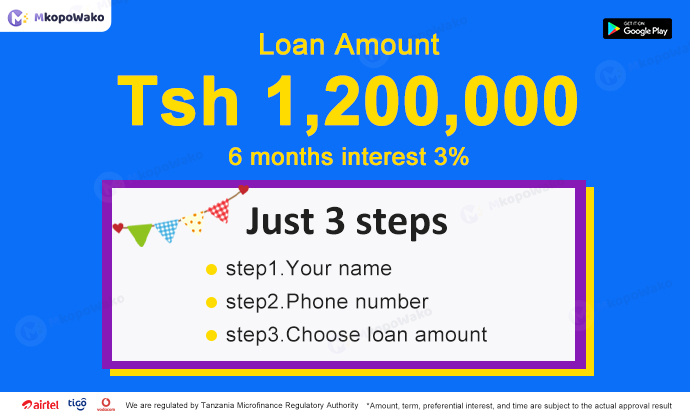

Tanzania is a country in East Africa that offers various options for borrowers seeking online loans. If you are considering borrowing 1 million Tanzanian shillings, it is important to understand the different repayment options available to you. This article will

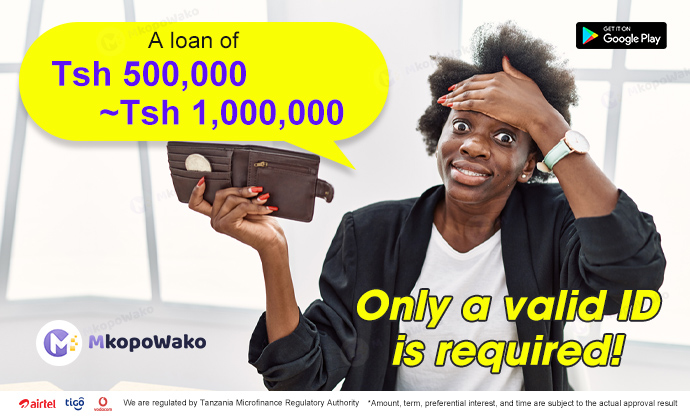

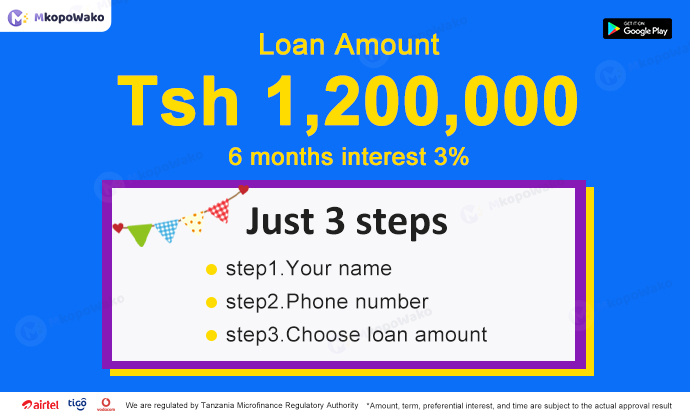

With the advancement of technology, accessing financial services has become easier than ever. In Tanzania, online loans have gained popularity as a convenient way to meet financial needs. Whether you need funds for personal reasons or business purposes, applying for

When applying for a loan, many people wonder whether it will affect their credit score. Understanding the impact of loan applications on credit scores is crucial for maintaining good financial health. Let’s delve into this topic to uncover the relationship

In the process of applying for a loan, common mistakes can lead to the application being rejected or delayed. Understanding these common errors and avoiding making the same mistakes in your loan application can help you successfully obtain a loan.

Getting your online loan application approved can be a challenging task, especially with the stringent criteria set by financial institutions. However, there are several strategies you can employ to improve your chances of approval. By understanding what lenders look for

In the fast-paced world we live in today, the process of applying for an online loan has become increasingly popular due to its convenience and accessibility. Many individuals turn to online lenders for various financial needs, whether it’s for personal

In today’s digital age, applying for a loan online has become a convenient and popular option. However, with so many loan products available, it can be overwhelming to choose the right one for your needs. This article will provide a

In today’s fast-paced world, people are increasingly turning to online loan applications for their convenience and speed. However, with the rise of cybercrime and data breaches, it is crucial to ensure that these loan applications are secure and protect the

In today’s digital age, accessing financial services online has become more convenient than ever. In Tanzania, individuals in need of personal loans can now apply for them through various online platforms. This article will provide a comprehensive guide on how

In Tanzania, what is the repayment period for online personal loans? Let’s delve into this topic and explore the ins and outs of the repayment terms for personal loans obtained through online platforms in Tanzania. Understanding Online Personal Loans in

In Tanzania, when it comes to online personal loans, borrowers can enjoy various flexible repayment options tailored to their needs. These options provide convenience and affordability, making it easier for individuals to manage their loan repayments effectively. Let’s delve into

As one of the East African countries, Tanzania’s financial technology industry has flourished in recent years, providing more convenient loan services to ordinary people. To apply for an online loan in Tanzania, there are some minimum requirements that you need

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status