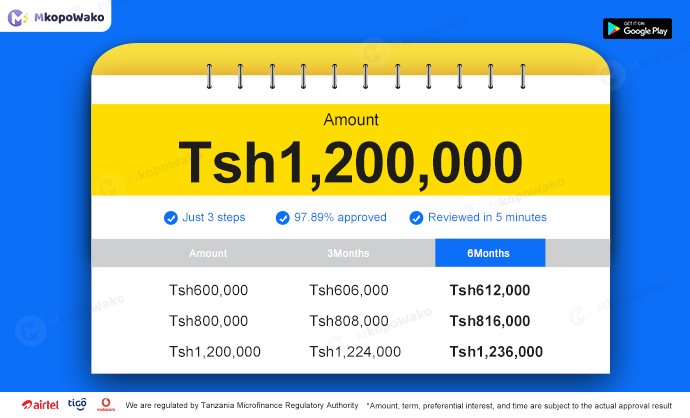

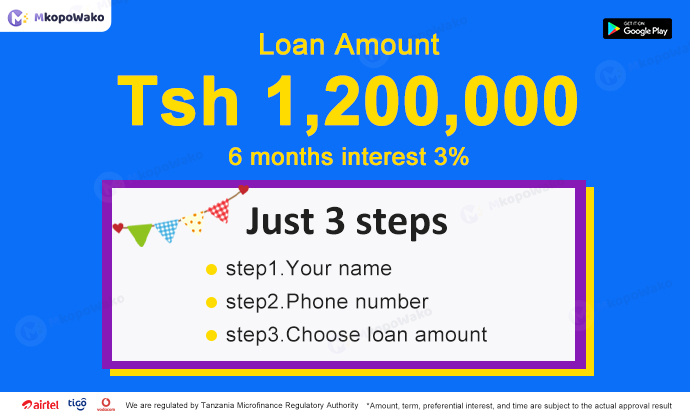

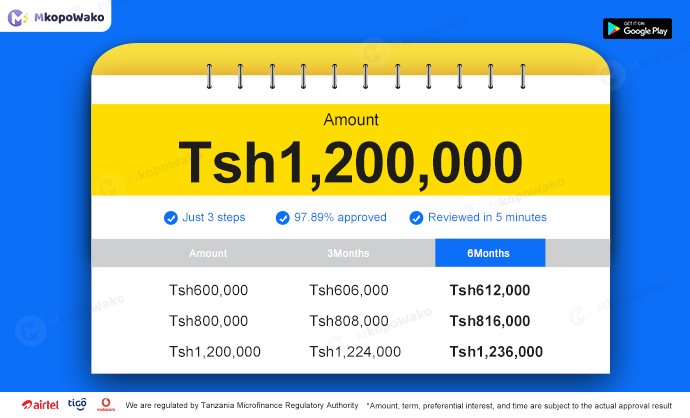

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

When it comes to obtaining a quick unsecured loan, one of the most important factors to consider is the approval process timeline. Many individuals are interested in finding out how long it takes for their loan to be processed and

In recent years, online lending has gained popularity in Tanzania as a quick and convenient way for individuals and businesses to access financial assistance. With the rise of digital platforms, borrowers can now apply for loans online and receive funds

When you need funds urgently, sometimes you can’t rely on a traditional bank loan. In this case, seeking an online loan may be a good option. In Tanzania, many people are turning to online loan services to solve their money

After your loan application is approved, what’s next? This question is undoubtedly on the minds of many applicants. Once your loan application is approved, the next steps are crucial as they will determine how you handle the borrowed funds and

Securing a loan is a crucial step in achieving financial goals, whether it’s for purchasing a home, starting a business, or funding higher education. Once you’ve submitted your loan application, it’s natural to wonder about its status and the next

In today’s digital age, applying for a loan online has become a convenient and streamlined process. Whether you need funds for unexpected expenses, a home renovation project, or debt consolidation, online loans offer a quick solution with easy access to

When applying for loans online, many individuals may wonder about the impact it will have on their credit scores. This article will explore the relationship between online loan applications and credit scores. We will delve into how applying for online

In today’s digital age, applying for a loan online has become a convenient and common practice. However, the success of your loan application depends on various factors that can impact the approval decision. To improve your chances of getting approved

When considering applying for a loan online, it is crucial to understand the various aspects of interest rates and fees associated with it. This comprehensive guide will delve into the intricacies of loan rates and fees for online applications, providing

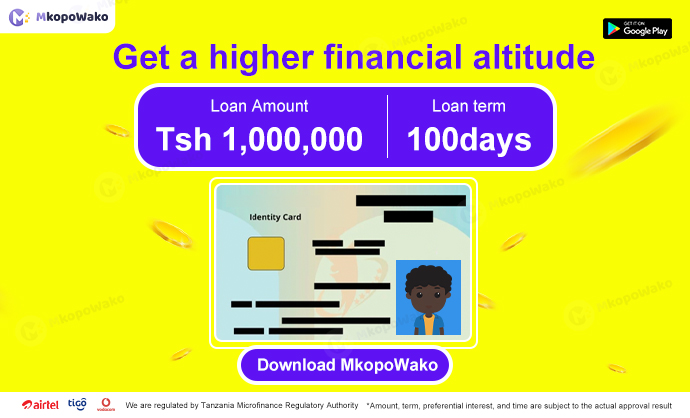

When applying for an online loan in Tanzania, it is very important to have complete documentation. Not only will these documents help you complete the loan application process faster, they will also increase your chances of successfully getting your loan.

In today’s fast-paced life, people are increasingly relying on online loans to meet their financial needs. As one of the fastest growing economies on the African continent, Tanzania has also followed the global trend in providing online loan services. When

Online lending has become increasingly popular in Tanzania, providing individuals and businesses with convenient access to quick financial assistance. However, with the rise of online lending platforms, concerns about the security of these services have also emerged. Ensuring the safety

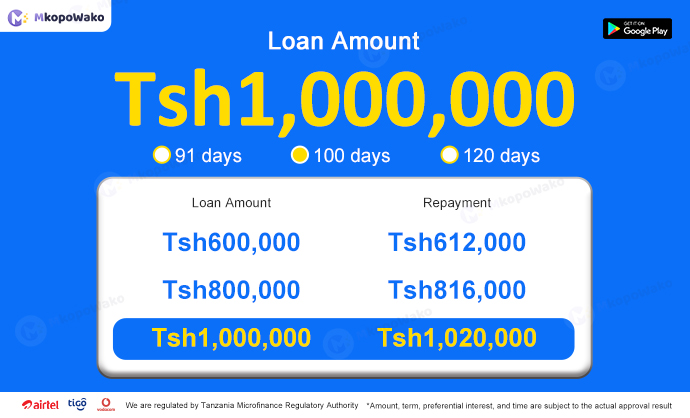

In Tanzania, when it comes to online personal loans, borrowers can enjoy various flexible repayment options tailored to their needs. These options provide convenience and affordability, making it easier for individuals to manage their loan repayments effectively. Let’s delve into

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status