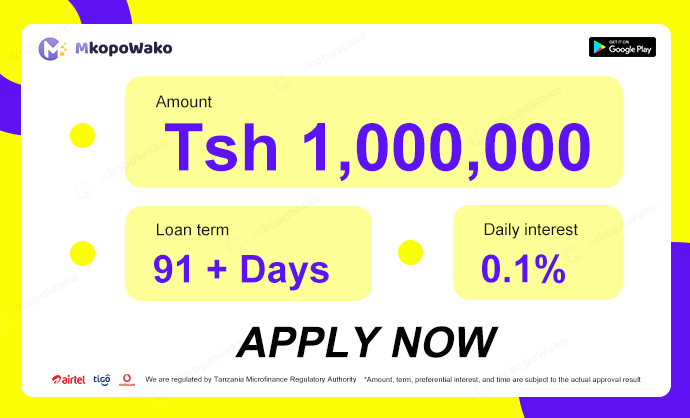

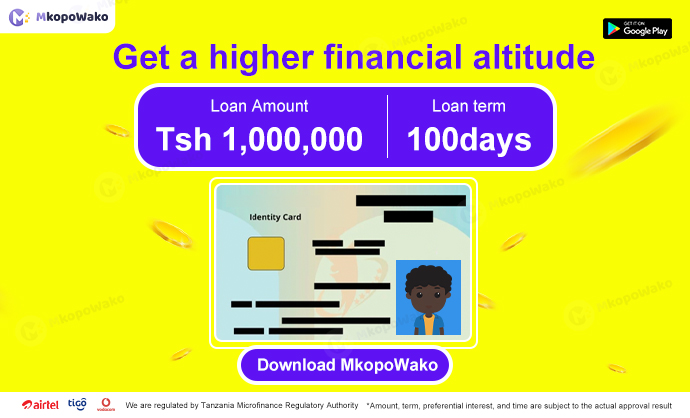

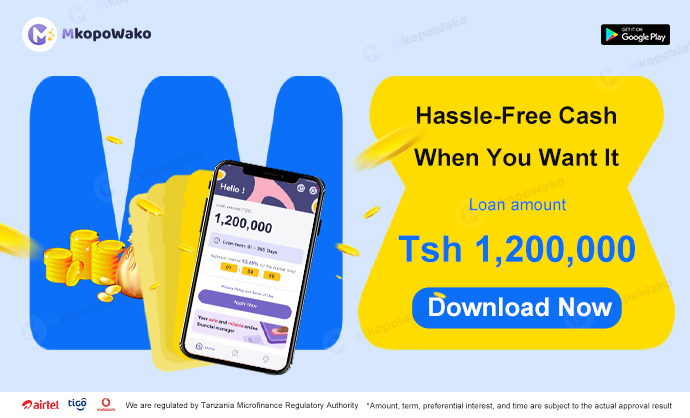

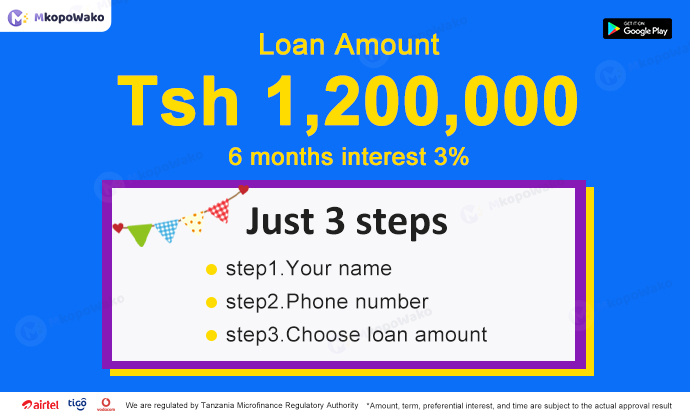

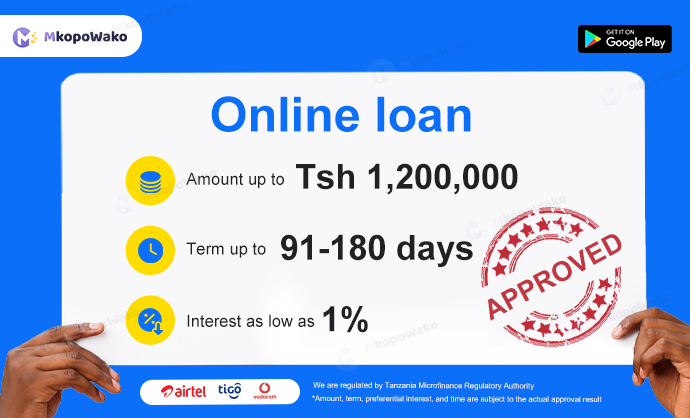

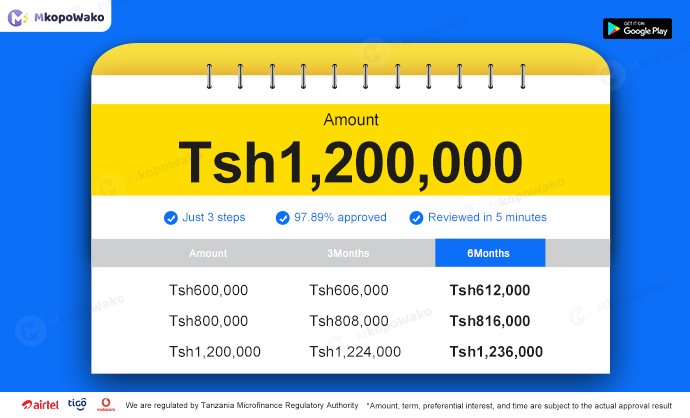

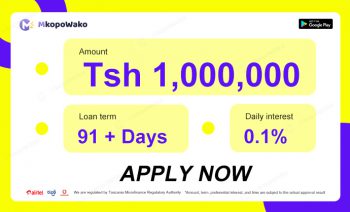

When it comes to applying for unsecured fast loans, understanding the specific requirements is crucial for a successful application. Unsecured loans are a popular choice for those looking to borrow money without having to provide collateral. These loans offer quick