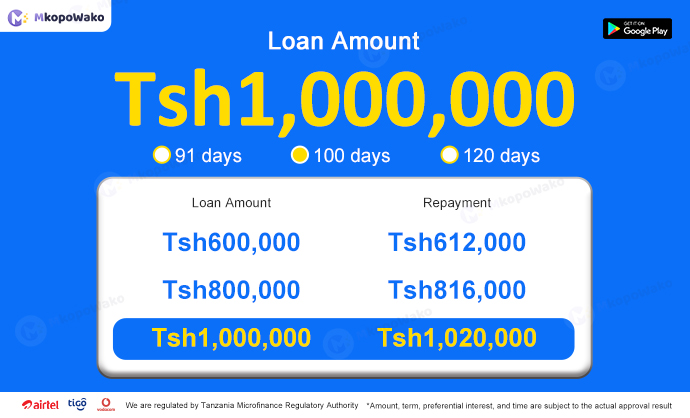

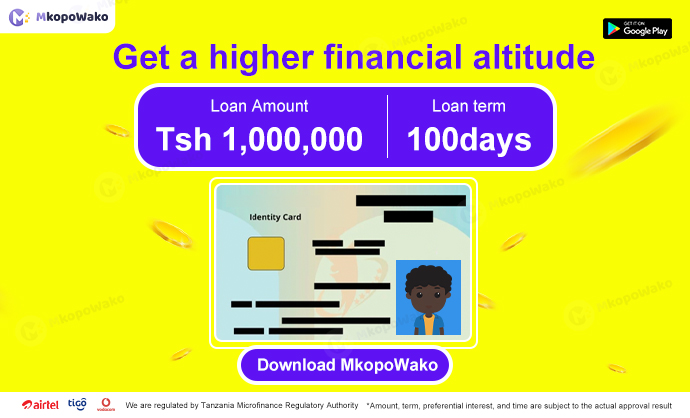

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

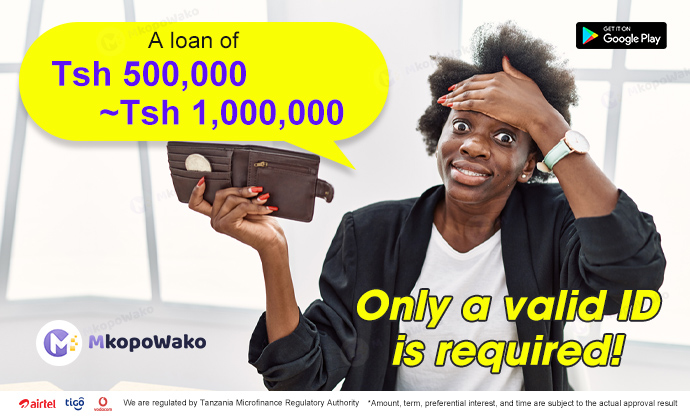

In the realm of quick loans, unsecured personal loans have become a popular option for individuals in need of fast financial assistance. One of the key attractions of these loans is the absence of collateral or a guarantor requirement. This

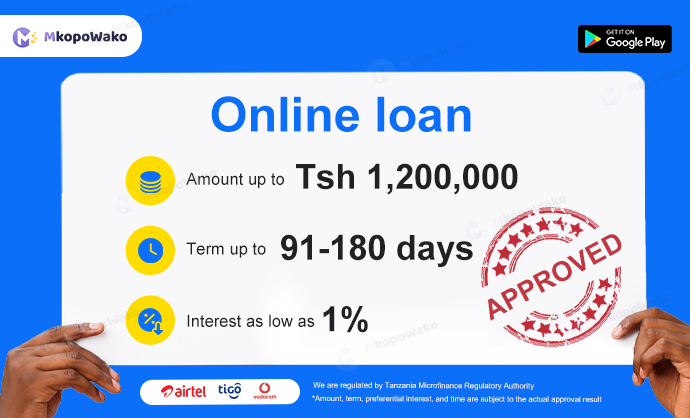

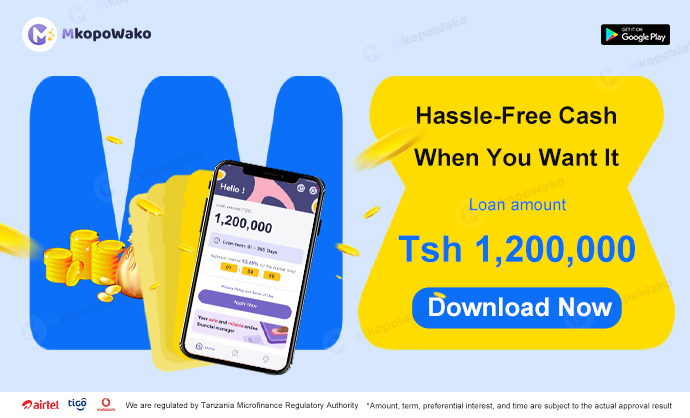

In recent years, online loans have gained popularity as a convenient and efficient way to access financial assistance. This trend is no different in Tanzania, where individuals and businesses can apply for online loans to meet their immediate financial needs.

Tanzania, located in East Africa, is a country known for its diverse landscapes, rich culture, and vibrant communities. In recent years, the need for quick loans has been on the rise in Tanzania, with individuals and businesses seeking financial assistance

When applying for a loan, having the necessary documents ready is crucial to ensure a smooth and successful process. Lenders require specific paperwork to assess your financial situation and determine your eligibility for a loan. By preparing all the required

Securing a loan is a crucial step in achieving financial goals, whether it’s for purchasing a home, starting a business, or funding higher education. Once you’ve submitted your loan application, it’s natural to wonder about its status and the next

Getting your online loan application approved can be a challenging task, especially with the stringent criteria set by financial institutions. However, there are several strategies you can employ to improve your chances of approval. By understanding what lenders look for

When applying for loans online, many individuals may wonder about the impact it will have on their credit scores. This article will explore the relationship between online loan applications and credit scores. We will delve into how applying for online

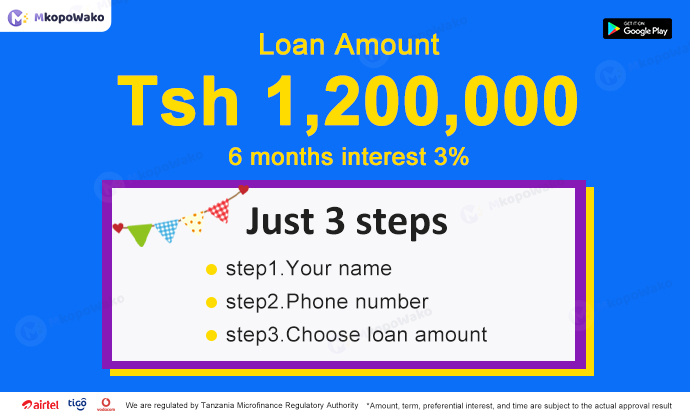

With the rapid development of the Internet, online loans have become more and more popular. Compared with traditional bank loans, online loans have the advantages of convenience, fast approval, and flexible repayment terms. In this article, we will introduce several

In recent years, online loan applications have become increasingly popular due to their convenience and accessibility. However, many people still have questions and concerns about the process. In this article, we will provide answers to some of the most common

In today’s digital age, accessing financial services online has become more convenient than ever. In Tanzania, individuals in need of personal loans can now apply for them through various online platforms. This article will provide a comprehensive guide on how

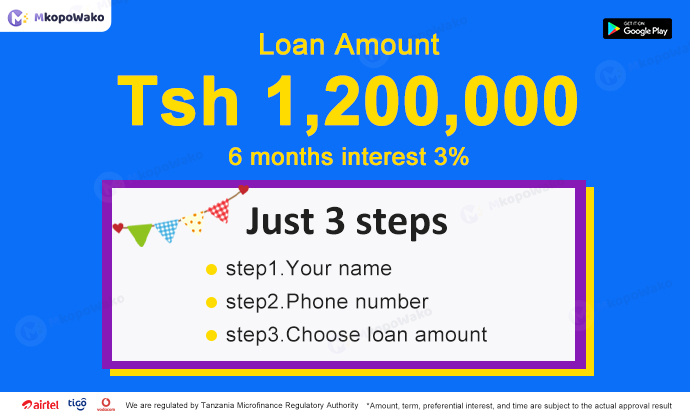

Tanzania’s financial sector has seen significant growth in recent years, with the rise of digital banking and online lending platforms providing more options for borrowers. Online lending has become particularly popular, as it allows borrowers to access funds quickly and

Online personal loans are becoming increasingly popular in Tanzania, as they offer a convenient and quick way to access funds. However, before taking out a loan, it is important to understand how the interest rates are calculated. The Annual Percentage

In today’s digital world, online loans have become a popular choice for individuals seeking quick and convenient access to funds. However, many people wonder whether applying for an online loan in Tanzania can have an impact on their personal credit.

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status