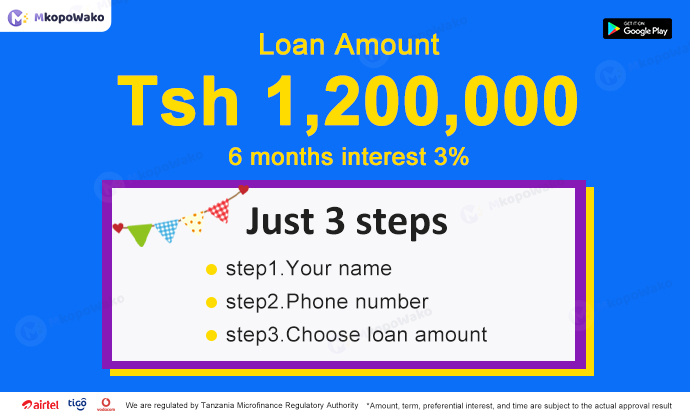

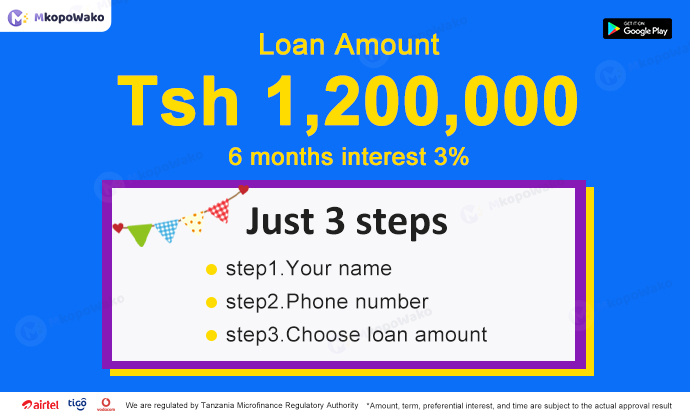

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

When it comes to unsecured quick loans, one of the most common questions borrowers have is about the loan amount they can qualify for. Understanding the loan limits for unsecured quick loans is crucial for anyone considering this type of

Securing a quick loan can be a pressing need for individuals in Tanzania facing unexpected expenses or seeking financial assistance for various purposes. Whether it’s for personal emergencies, business ventures, or other financial obligations, there are avenues available for obtaining

When it comes to securing a loan of one million Tanzanian shillings online, many individuals may wonder about the approval process and how long it will take. Understanding the intricacies and timeline of the approval process for such a substantial

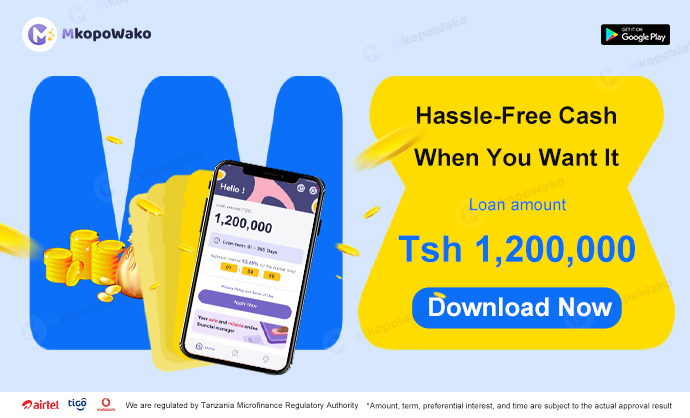

With the advancement of technology, accessing financial services has become easier than ever. In Tanzania, online loans have gained popularity as a convenient way to meet financial needs. Whether you need funds for personal reasons or business purposes, applying for

Being denied a loan can be a frustrating and disheartening experience. However, it’s important to remember that a loan denial is not the end of the road. There are several steps you can take to improve your chances of future

In today’s digital age, applying for loans has become easier and more convenient than ever. With just a few clicks, you can access multiple lenders and compare their offerings to find the best loan option for your needs. However, when

Applying for a loan can be a time-consuming process, and waiting for approval can add to the stress. Luckily, with online loan applications, checking the progress of your application has become easier than ever before. In this article, we will

In today’s digital age, online loan applications have become increasingly popular and convenient. However, many individuals still make common mistakes when applying for loans online. These mistakes can lead to delays in the approval process or even rejection of the

In today’s digital age, applying for a loan online has become a convenient and common practice. However, the success of your loan application depends on various factors that can impact the approval decision. To improve your chances of getting approved

In recent years, online loan applications have become increasingly popular due to their convenience and accessibility. However, many people still have questions and concerns about the process. In this article, we will provide answers to some of the most common

When applying for an online loan in Tanzania, it is very important to have complete documentation. Not only will these documents help you complete the loan application process faster, they will also increase your chances of successfully getting your loan.

In Tanzania, what is the repayment period for online personal loans? Let’s delve into this topic and explore the ins and outs of the repayment terms for personal loans obtained through online platforms in Tanzania. Understanding Online Personal Loans in

Online personal loans are becoming increasingly popular in Tanzania, as they offer a convenient and quick way to access funds. However, before taking out a loan, it is important to understand how the interest rates are calculated. The Annual Percentage

As one of the East African countries, Tanzania’s financial technology industry has flourished in recent years, providing more convenient loan services to ordinary people. To apply for an online loan in Tanzania, there are some minimum requirements that you need

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status