When it comes to obtaining a quick unsecured loan, one of the most important factors to consider is the approval process timeline. Many individuals are interested in finding out how long it takes for their loan to be processed and

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

When it comes to obtaining a quick unsecured loan, one of the most important factors to consider is the approval process timeline. Many individuals are interested in finding out how long it takes for their loan to be processed and

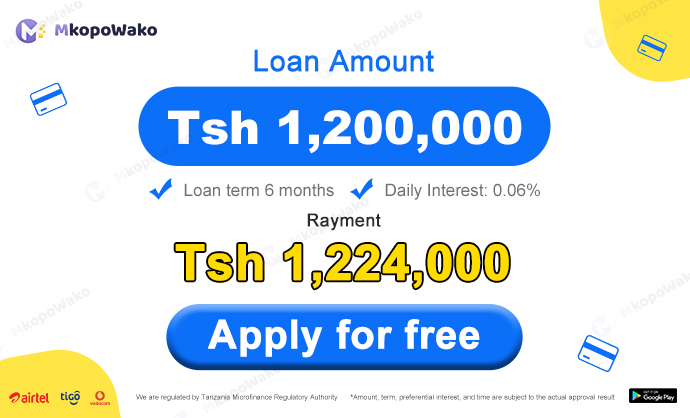

In today’s fast-paced world, the need for financial assistance can arise at any moment. Whether it’s for business expansion, personal investments, or emergency situations, having access to a substantial amount of money can make a significant difference. For individuals in

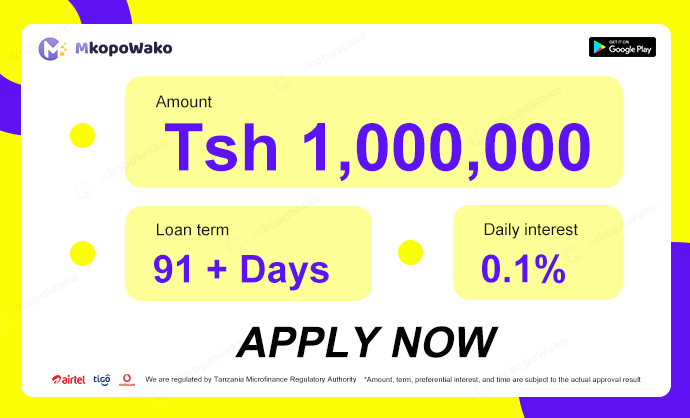

When it comes to securing a loan of one million Tanzanian shillings online, many individuals may wonder about the approval process and how long it will take. Understanding the intricacies and timeline of the approval process for such a substantial

When applying for a loan, many people wonder whether it will affect their credit score. Understanding the impact of loan applications on credit scores is crucial for maintaining good financial health. Let’s delve into this topic to uncover the relationship

In today’s digital age, applying for loans has become easier and more convenient than ever. With just a few clicks, you can access multiple lenders and compare their offerings to find the best loan option for your needs. However, when

Once you have successfully applied for an online loan and been approved, the next steps are critical. Knowing what to do next will help ensure you handle your borrowing correctly and avoid possible problems. From how to receive funds to

In today’s digital age, applying for a loan online has become a convenient and popular option. However, with so many loan products available, it can be overwhelming to choose the right one for your needs. This article will provide a

Before applying for a loan, it’s important to choose the right loan product. Different loan products have different features and are suitable for different people, such as personal consumption loans, car loans, mortgages, education loans, etc. You need to choose

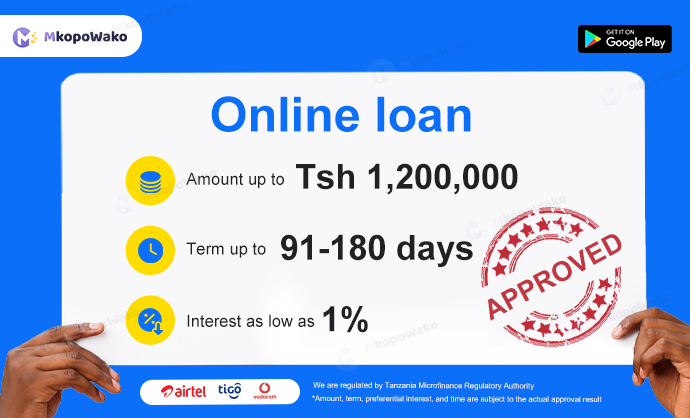

Getting a loan used to be a lengthy and cumbersome process, but with the rise of online lending platforms, borrowers now have access to fast and convenient loan approval. In Tanzania, online loans have gained popularity due to their quick

When considering taking out an online loan in Tanzania, one crucial aspect to investigate is whether there are any prepayment fees associated with the loan. Prepayment fees can significantly impact the overall cost of borrowing and should be thoroughly understood

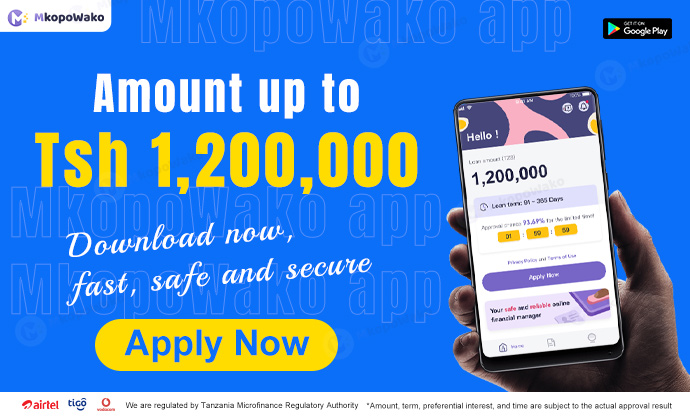

As one of the East African countries, Tanzania’s financial technology industry has flourished in recent years, providing more convenient loan services to ordinary people. To apply for an online loan in Tanzania, there are some minimum requirements that you need

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status

for Andriod

Free

In Tanzania V1.2.0

5.0 (1 million +)

Security Status