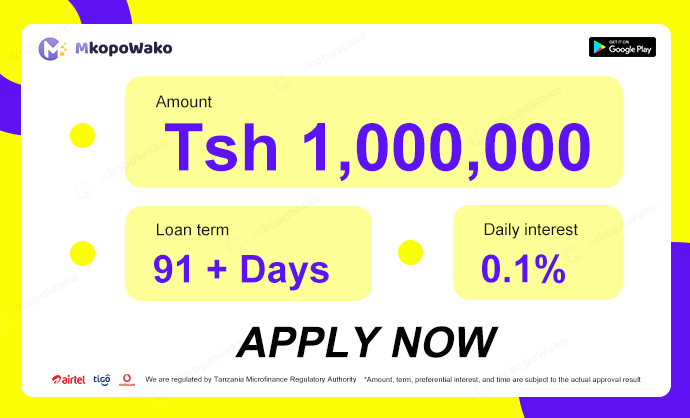

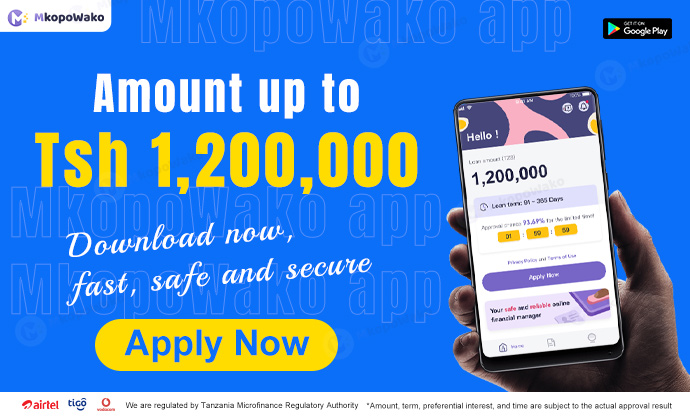

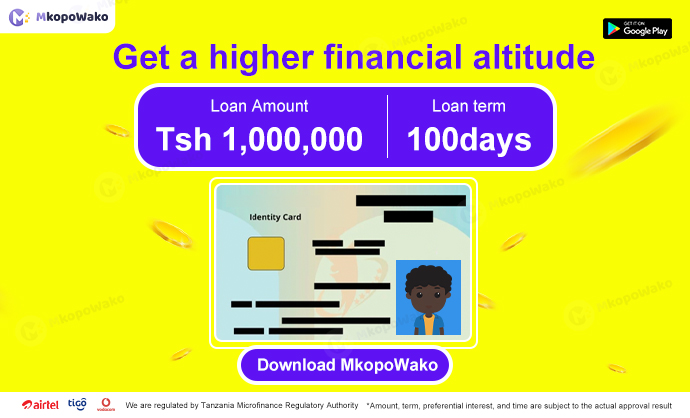

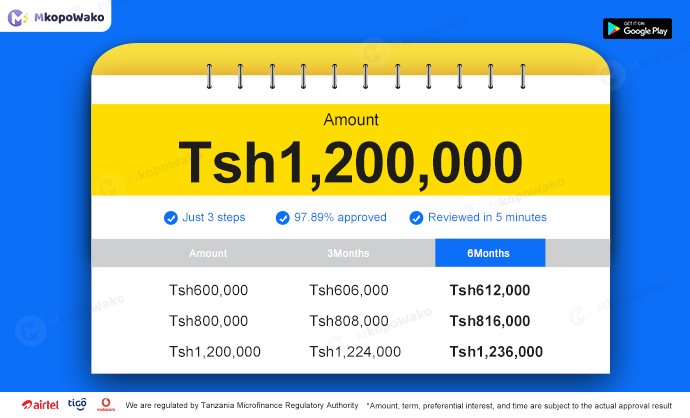

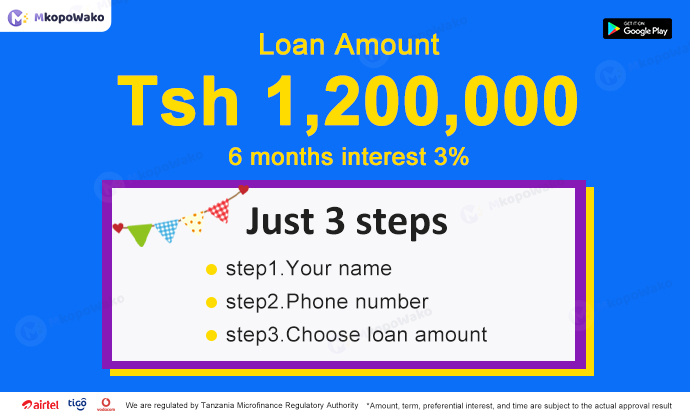

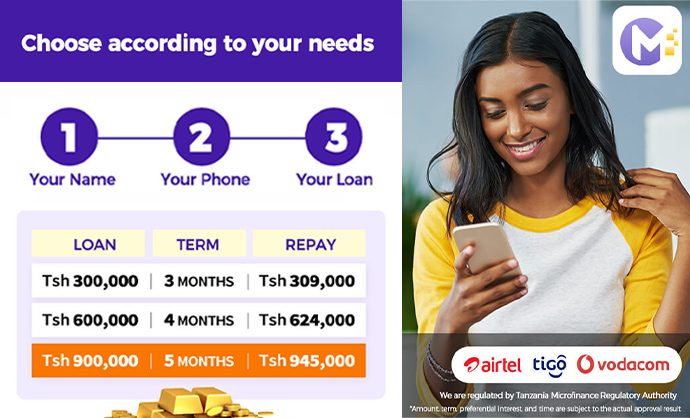

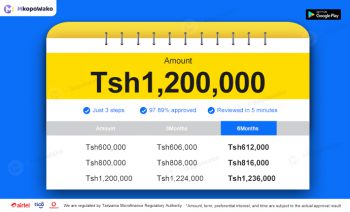

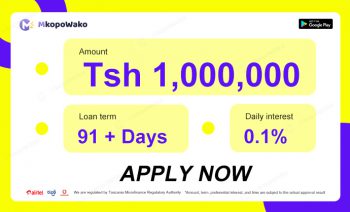

The interest rate for unsecured quick loans varies depending on the lender and the borrower’s creditworthiness. In general, unsecured quick loans tend to have higher interest rates compared to secured loans due to the lack of collateral. These loans provide