What are the necessary documents for a loan application?

When applying for a loan, having the necessary documents ready is crucial to ensure a smooth and successful process. Lenders require specific paperwork to assess your financial situation and determine your eligibility for a loan. By preparing all the required documents in advance, you can expedite the application process and increase your chances of approval. In this comprehensive guide, we will outline the essential documents needed for a loan application, helping you navigate the process with ease and confidence.

1. Personal Identification

One of the primary documents you will need when applying for a loan is personal identification. This typically includes a government-issued ID such as a driver’s license, passport, or state ID card. Your ID serves to verify your identity and confirm that you are who you claim to be. Make sure your identification documents are current and valid to avoid any delays in the application process.

2. Proof of Income

Lenders need to assess your ability to repay the loan, which is why they require proof of income. This can include recent pay stubs, tax returns, W-2 forms, or bank statements. Self-employed individuals may need to provide additional documentation such as profit and loss statements or business tax returns. By demonstrating a stable income, you can strengthen your loan application and improve your chances of approval.

3. Employment Verification

In addition to proof of income, lenders may request employment verification to validate your current job status and stability. This can be done through a letter from your employer, recent pay stubs showing your employer’s information, or direct contact with your HR department. Consistent employment history can boost your credibility as a borrower and reassure lenders of your repayment capacity.

4. Credit History

Your credit history plays a significant role in the loan approval process, as it reflects your past borrowing behavior and creditworthiness. Lenders will typically review your credit report from one or more credit bureaus to assess your risk level. It’s essential to review your credit report beforehand to check for any errors or discrepancies that may impact your loan application. Maintaining a good credit score can open up more favorable loan options and terms.

5. Debt Obligations

Disclosing your existing debt obligations is crucial for lenders to evaluate your debt-to-income ratio and overall financial health. This includes information on outstanding loans, credit card balances, mortgages, and any other financial commitments. By providing a clear overview of your existing debts, you can help lenders make an informed decision regarding your loan application.

6. Collateral Documents (if applicable)

If you are applying for a secured loan that requires collateral, you will need to provide documentation related to the asset(s) being used as security. This can include property deeds, vehicle titles, investment statements, or any other proof of ownership. Lenders may require appraisals or valuations of the collateral to determine its value and eligibility for the loan. By preparing collateral documents in advance, you can streamline the approval process for secured loans.

In conclusion, preparing the necessary documents is key to a successful loan application process. By ensuring you have all the required paperwork ready, you can demonstrate your financial stability, creditworthiness, and repayment capacity to lenders. Remember to organize your documents neatly, double-check for completeness and accuracy, and submit them promptly to expedite the review process. With thorough preparation and attention to detail, you can increase your chances of securing the loan you need for your financial goals.

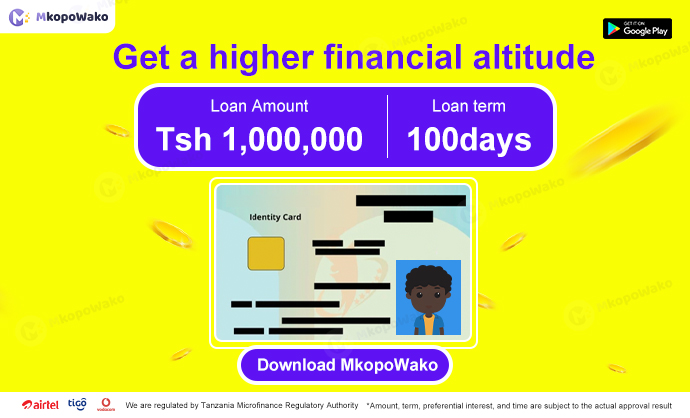

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status