Can I submit multiple online loan applications at the same time?

In today’s digital age, applying for loans has become easier and more convenient than ever. With just a few clicks, you can access multiple lenders and compare their offerings to find the best loan option for your needs. However, when it comes to submitting online loan applications, is it possible to apply for multiple loans simultaneously? In this article, we will explore this question and provide you with a comprehensive answer.

Introduction

Online loan applications have revolutionized the borrowing process by eliminating the need for physical paperwork and lengthy approval times. Many people wonder if they can increase their chances of approval by submitting multiple loan applications at the same time. While it may seem tempting to cast a wide net and apply to multiple lenders simultaneously, there are certain factors to consider before doing so.

Understanding Credit Inquiries

When you apply for a loan, the lender will request a copy of your credit report to assess your creditworthiness. This process involves a credit inquiry, which is recorded on your credit file. Multiple credit inquiries within a short period can negatively impact your credit score. Lenders may view this as a sign of financial desperation or excessive borrowing, which could make them less likely to approve your loan application.

The Impact on Your Credit Score

Each credit inquiry typically results in a small decrease in your credit score. However, the impact is usually minimal and temporary. If you submit multiple loan applications within a short period, the credit bureaus may recognize this as rate shopping and treat it as a single credit inquiry. In such cases, the impact on your credit score would be minimal.

Considerations Before Applying to Multiple Lenders

Before applying to multiple lenders, consider the following factors:

1. Time and Effort: Applying for loans requires time and effort. Be prepared to complete multiple applications and provide the necessary documentation for each lender.

2. Loan Terms and Conditions: Each lender may offer different loan terms, interest rates, and repayment options. Take the time to compare these factors before submitting your applications.

3. Eligibility Criteria: Lenders have specific eligibility criteria that borrowers must meet. While you may be eligible for one lender, you may not meet the requirements of another. Ensure you meet the criteria before applying.

Conclusion

In summary, while it is technically possible to submit multiple online loan applications simultaneously, there are several factors to consider before doing so. Multiple credit inquiries within a short period can negatively impact your credit score, potentially affecting your chances of loan approval. It is crucial to weigh the benefits against the potential drawbacks before deciding to apply to multiple lenders at once. Remember, it is essential to make informed borrowing decisions and choose the loan option that best suits your financial needs.

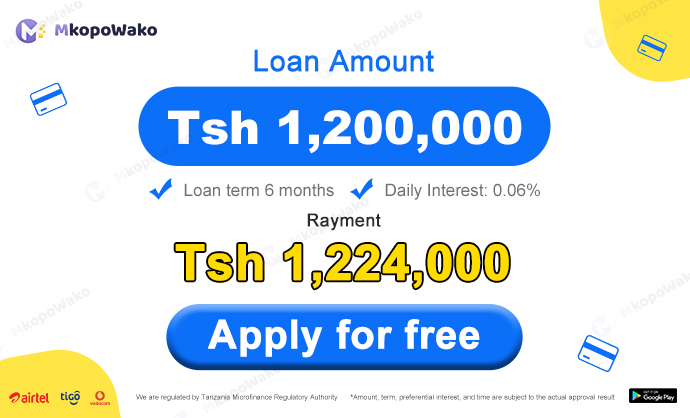

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status