How do I check the status of my loan application?

Securing a loan is a crucial step in achieving financial goals, whether it’s for purchasing a home, starting a business, or funding higher education. Once you’ve submitted your loan application, it’s natural to wonder about its status and the next steps in the process. Understanding how to check the status of your loan application can provide peace of mind and help you stay informed throughout the journey. In this article, we’ll explore the various methods and tips to effectively monitor the status of your loan application, ensuring that you stay updated every step of the way.

1. Utilize Online Banking or Lender’s Portal

One of the most convenient ways to check the status of your loan application is through online banking or the lender’s portal. Many financial institutions and lending agencies offer secure online platforms where applicants can log in and track the progress of their loan applications in real-time. Upon logging in, you may find a dedicated section or dashboard that displays the current status, any pending requirements, and estimated timelines for approval or rejection. Additionally, these platforms often provide notifications and updates, keeping you informed without the need for frequent inquiries.

2. Contact Your Loan Officer or Customer Service

If you prefer direct communication, reaching out to your assigned loan officer or customer service representative can yield valuable insights into your application’s status. Loan officers are typically responsible for managing and processing applications, making them well-equipped to provide updates and address any concerns you may have. Customer service teams can also offer assistance and connect you with the relevant personnel to inquire about your application. When contacting them, be sure to have your application ID or reference number ready for efficient assistance.

3. Monitor Email and Text Notifications

During the loan application process, it’s essential to stay vigilant with your email and text messages, as lenders often use these channels to communicate important updates and requests for additional information. Be sure to regularly check your inbox, including the spam or promotions folder, for any correspondence related to your application. Additionally, some lenders may send automated text alerts regarding the progress of your application, ensuring that you stay informed in a timely manner.

4. Check Credit Report and Credit Monitoring Services

Your credit report can provide valuable insights into the status of your loan application, especially if the lender has conducted a credit check as part of the evaluation process. Monitoring your credit report for any inquiries or updates from the lender can offer clues about the progress of your application. Furthermore, subscribing to credit monitoring services can provide ongoing access to your credit report and notify you of any changes or activities related to your loan application, helping you stay informed about the decision-making process.

5. Review Application Tracking Tools

Some lenders offer application tracking tools on their websites or mobile apps, allowing applicants to monitor the various stages of their loan application. These tracking tools may provide a visual timeline or checklist of required steps, such as document submission, verification, underwriting, and final decision. By regularly reviewing these tracking tools, you can gain a comprehensive understanding of where your application stands and anticipate the next actions needed to move the process forward.

6. Seek Updates on Loan Processor’s or Underwriter’s Evaluation

As the loan application undergoes evaluation by the processor and underwriter, it’s beneficial to inquire about the status directly from these key individuals or departments. Understanding the specific criteria being assessed and any outstanding requirements can help you proactively address any potential issues and expedite the decision-making process. By seeking updates on the evaluation progress, you demonstrate your commitment and responsibility as an applicant, potentially influencing a favorable outcome.

In conclusion, monitoring the status of your loan application is essential for staying informed and proactive throughout the borrowing process. Whether through online platforms, direct communication, or credit monitoring, leveraging multiple methods can provide a comprehensive view of your application’s progress. By staying engaged and informed, you not only demonstrate responsible financial behavior but also position yourself to respond effectively to any developments. Ultimately, maintaining awareness of your loan application status empowers you to navigate the borrowing journey with confidence and clarity.

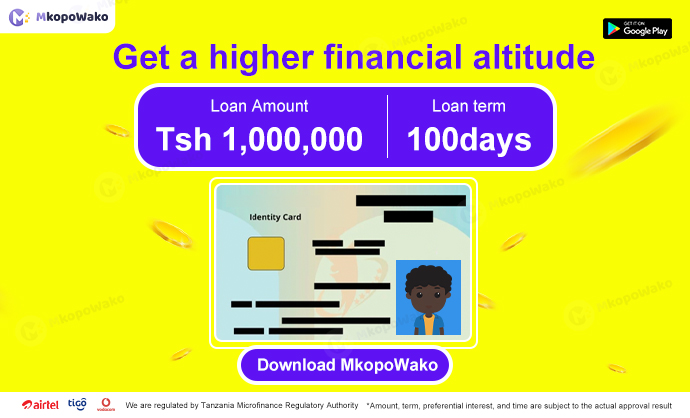

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status