How can I improve my loan application approval rate?

When applying for a loan, getting approved is the ultimate goal. However, the process can be daunting, and many applicants face rejection due to various reasons. To increase your chances of getting approved for a loan, there are several factors to consider. From managing your credit score to preparing necessary documentation, here’s a comprehensive guide to improving your loan approval rate.

Understanding Your Credit Score

credit-score

Your credit score plays a crucial role in the loan approval process. Lenders use it to assess your creditworthiness and determine the interest rate for your loan. Understanding your credit score and taking steps to improve it can significantly impact your loan application‘s success. Make sure to review your credit report regularly, identify any discrepancies, and address them promptly. Additionally, focus on reducing outstanding debts and making timely payments to boost your credit score.

Debt-to-Income Ratio Management

debt-to-income-ratio

Lenders also consider your debt-to-income ratio when evaluating your loan application. This ratio compares your monthly debt payments to your gross monthly income. Keeping this ratio at a healthy level demonstrates your ability to manage additional debt responsibly. To improve your chances of loan approval, work on paying off existing debts and avoid taking on new ones that could negatively impact your debt-to-income ratio.

Savings and Down Payment

savings-down-payment

Having savings and a substantial down payment can strengthen your loan application. A larger down payment reduces the amount you need to borrow, showcasing your financial stability and commitment. It also lowers the lender’s risk, making them more inclined to approve your loan. Prioritize building up your savings and setting aside funds for a significant down payment to improve the likelihood of loan approval.

Document Preparation and Accuracy

document-preparation

Accurate and organized documentation is vital for a successful loan application. Prepare all required documents, such as tax returns, pay stubs, bank statements, and employment history, well in advance. Ensure that the information provided is accurate and up to date. Any discrepancies or missing information can lead to delays or denial of your loan application. By presenting thorough and precise documentation, you can enhance your chances of approval.

Stable Employment and Income

employment-income

Lenders prefer applicants with stable employment and a consistent income stream. A reliable job history and steady income demonstrate your ability to repay the loan on time. Avoid changing jobs frequently before applying for a loan, as it may raise concerns about your stability and affect your approval chances. If possible, secure a steady source of income and maintain stable employment to strengthen your loan application.

Shop Around for Lenders

lender-comparison

Not all lenders have the same criteria for approving loans. It’s essential to shop around and compare offers from different lenders. Research various financial institutions, including banks, credit unions, and online lenders, to find the best terms and rates. By exploring multiple options, you can increase your chances of finding a lender willing to approve your loan under favorable conditions.

Improving your loan approval rate requires careful attention to various financial aspects. By managing your credit score, debt-to-income ratio, savings, documentation, employment stability, and lender comparison, you can enhance your eligibility for a loan. Remember that each aspect contributes to your overall financial profile, and addressing them systematically can significantly increase your chances of getting approved for the loan you need.

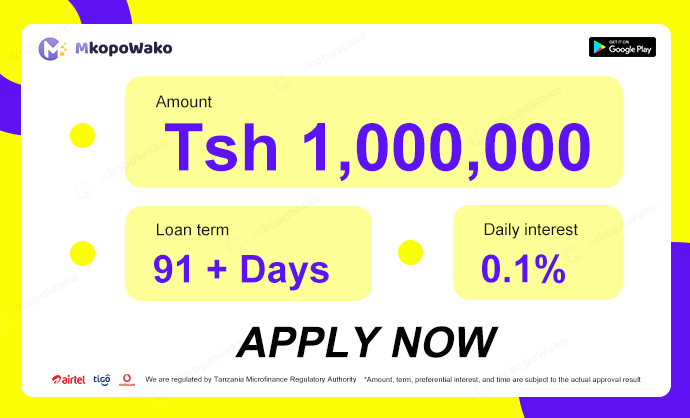

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status