How can I improve my online loan application approval rate?

Getting your online loan application approved can be a challenging task, especially with the stringent criteria set by financial institutions. However, there are several strategies you can employ to improve your chances of approval. By understanding what lenders look for and taking proactive steps to strengthen your application, you can increase the likelihood of being approved for the loan you need. Below are some effective tips to help you boost your online loan application approval rate.

Evaluate Your Credit Score

One of the key factors that lenders consider when reviewing loan applications is the applicant’s credit score. Before applying for an online loan, it’s essential to check your credit score and ensure that it is in good standing. A higher credit score demonstrates your creditworthiness and reliability in repaying debts, making you a more attractive borrower in the eyes of lenders. If your credit score is low, take steps to improve it before submitting your loan application.

Provide Accurate and Complete Information

When filling out the online loan application, make sure to provide accurate and complete information. Any discrepancies or missing details could raise red flags with the lender and lead to rejection. Double-check all the information you provide, including your personal details, income, employment history, and financial assets. Providing thorough and precise information will not only expedite the approval process but also instill confidence in the lender regarding your credibility.

Choose the Right Loan Amount

Selecting the appropriate loan amount is crucial when applying for an online loan. Be realistic about how much you need to borrow and ensure that you can comfortably afford the repayments. Lenders assess your debt-to-income ratio to determine your ability to repay the loan, so choosing a reasonable loan amount increases your chances of approval. Avoid borrowing more than you can afford, as it may signal financial instability to the lender.

Shop Around for Lenders

Before submitting your online loan application, take the time to shop around and compare offers from different lenders. Each lender has its own set of criteria and interest rates, so exploring multiple options allows you to find the best terms for your financial situation. Consider factors such as interest rates, repayment terms, and fees when evaluating loan offers. By researching and comparing lenders, you can increase your chances of securing a loan with favorable terms.

Provide Collateral or a Co-Signer

If you have a low credit score or insufficient income to qualify for an online loan on your own, consider providing collateral or having a co-signer on the application. Collateral, such as a vehicle or property, offers security to the lender in case of default, making them more inclined to approve your application. Similarly, having a co-signer with a strong credit history can strengthen your application and improve your chances of approval.

Follow Up and Stay Informed

After submitting your online loan application, follow up with the lender to inquire about the status of your application. Stay informed about any additional documentation or steps required to process your application promptly. Being proactive and responsive to any requests from the lender demonstrates your commitment and reliability as a borrower. By staying engaged throughout the application process, you can increase the likelihood of a successful loan approval.

Conclusion

Securing approval for an online loan can be a competitive process, but by following these tips and taking proactive measures, you can enhance your chances of success. Evaluating your credit score, providing accurate information, selecting the right loan amount, shopping around for lenders, considering collateral or a co-signer, and staying informed throughout the process are key steps to increasing your online loan application approval rate. By presenting yourself as a reliable and responsible borrower, you can improve your chances of securing the financing you need.

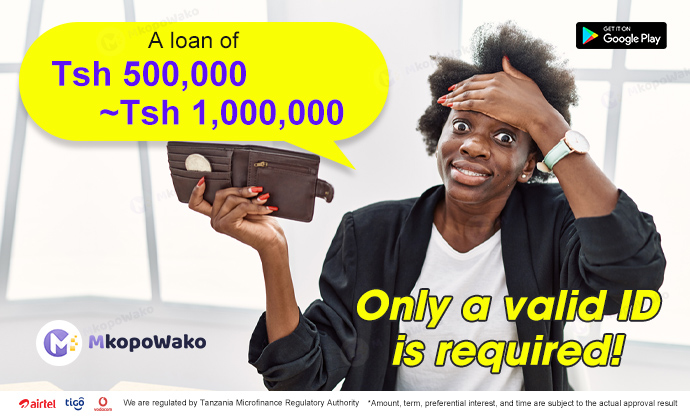

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status