What are the most common mistakes when applying for an online loan?

In today’s digital age, online loan applications have become increasingly popular and convenient. However, many individuals still make common mistakes when applying for loans online. These mistakes can lead to delays in the approval process or even rejection of the loan application. In this article, we will explore the most common errors people make when applying for online loans and provide tips to avoid them.

1. Insufficient Research

Before applying for an online loan, it’s crucial to research and compare different lenders. Many borrowers make the mistake of not thoroughly researching the terms and conditions, interest rates, and repayment options offered by various lenders. This lack of research can result in choosing a loan that is not the best fit for their financial situation.

To avoid this mistake, take the time to research multiple lenders, read customer reviews, and compare loan terms. Look for lenders with positive reputations, reasonable interest rates, and flexible repayment options.

2. Inaccurate or Incomplete Information

Providing inaccurate or incomplete information is another common mistake in online loan applications. Lenders rely on the information provided by borrowers to assess their creditworthiness and determine the loan amount and interest rate. Any inconsistencies or missing details can lead to delays or denial of the loan.

To prevent this mistake, double-check all the information you provide in the loan application form. Make sure your personal details, employment history, income, and expenses are accurate and up-to-date. Submitting complete and correct information will increase your chances of approval.

3. Neglecting Credit Score

Your credit score plays a significant role in the loan approval process. Many applicants overlook the importance of checking their credit score before applying for an online loan. A low credit score can result in higher interest rates or even rejection of the loan.

To avoid this mistake, obtain a copy of your credit report and review it carefully. If there are any errors or discrepancies, contact the credit reporting agency to rectify them. Additionally, take steps to improve your credit score before applying for a loan, such as paying off outstanding debts and making timely payments.

4. Applying for Multiple Loans Simultaneously

Some individuals make the mistake of applying for multiple loans simultaneously, thinking it will increase their chances of approval. However, this can have a negative impact on their credit score and loan applications. Each loan application creates a hard inquiry on your credit report, which can lower your credit score.

To avoid this mistake, focus on applying for loans that best suit your needs instead of submitting multiple applications. Choose lenders that are likely to approve your application based on your credit score and financial situation.

5. Ignoring the Fine Print

Another common mistake is ignoring the fine print and not thoroughly reading the terms and conditions of the loan. Borrowers often skim through the agreement without fully understanding the interest rates, repayment terms, fees, and penalties associated with the loan.

To prevent this mistake, take the time to read the loan agreement carefully. Pay attention to the interest rate, repayment schedule, any hidden fees, and penalties for late payments or early repayment. Understanding the terms and conditions will help you make an informed decision and avoid any surprises in the future.

6. Failing to Review the Application

Finally, many applicants make the mistake of not reviewing their loan application before submitting it. This oversight can lead to errors or missing information, which can delay the approval process.

To avoid this mistake, review your loan application thoroughly before clicking the submit button. Check for any mistakes, ensure all the required fields are filled out, and verify that the information provided is accurate and up-to-date.

In conclusion, when applying for an online loan, it’s essential to conduct thorough research, provide accurate information, prioritize your credit score, avoid multiple loan applications, read the fine print, and review your application before submission. By avoiding these common mistakes, you can increase your chances of a successful loan application and secure the funding you need.

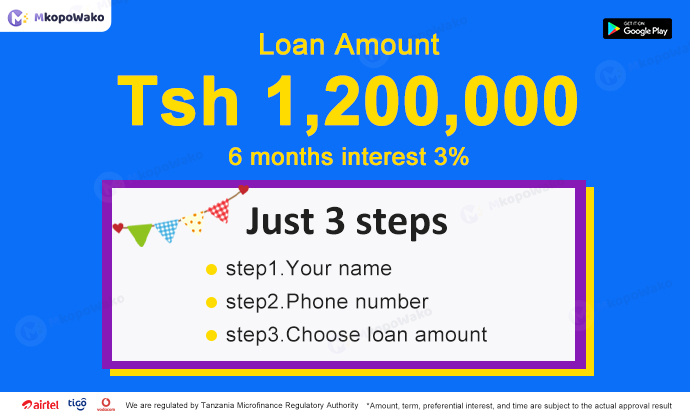

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status