Will online loan applications affect my credit score?

When applying for loans online, many individuals may wonder about the impact it will have on their credit scores. This article will explore the relationship between online loan applications and credit scores. We will delve into how applying for online loans can affect your credit score, what factors are involved, and provide tips on managing your credit score when seeking online loans.

The Impact of Online Loan Applications on Credit Scores

Applying for a loan online can indeed have an impact on your credit score. When you submit an application for a loan, the lender will typically perform a credit inquiry to assess your creditworthiness. This credit inquiry can be categorized as a “hard inquiry,” which can have a temporary negative effect on your credit score.

Understanding Hard Inquiries and Credit Scores

Hard inquiries occur when a lender checks your credit report as part of their decision-making process. Each hard inquiry can cause a small dip in your credit score, usually by a few points. While this impact is minor, multiple hard inquiries within a short period can add up and potentially lower your credit score more significantly.

Factors Influencing the Impact on Credit Scores

Several factors can determine the extent of the impact of online loan applications on your credit score. These factors include the number of inquiries made, the frequency of applications, the types of loans applied for, and your overall credit history. It’s essential to be mindful of these factors when applying for loans online to minimize any negative effects on your credit score.

Tips for Managing Your Credit Score When Applying for Online Loans

1. Limit the Number of Loan Applications: Avoid submitting multiple loan applications within a short period to reduce the number of hard inquiries on your credit report.

2. Research Loan Options: Before applying for a loan online, compare different lenders and loan options to find the best fit for your financial needs. This can help you narrow down your choices and apply selectively.

3. Check Your Credit Report Regularly: Monitor your credit report regularly to stay informed about any inquiries or changes to your credit profile. This can help you detect any errors and address them promptly.

4. Improve Your Credit Health: Work on improving your overall credit health by making timely payments, keeping your credit utilization low, and managing debts responsibly. A strong credit profile can help mitigate the impact of loan applications on your credit score.

5. Consider Prequalification: Some lenders offer prequalification processes that allow you to check your eligibility for a loan without a hard inquiry. This can help you assess your options without affecting your credit score.

6. Seek Professional Advice: If you’re unsure about how online loan applications may impact your credit score, consider seeking advice from a financial advisor or credit counselor. They can provide personalized guidance based on your financial situation.

Conclusion

In conclusion, applying for loans online can impact your credit score through hard inquiries made by lenders. It’s essential to be aware of how these inquiries can affect your credit score and take steps to manage your credit health effectively. By limiting the number of applications, researching loan options, monitoring your credit report, and seeking professional advice when needed, you can navigate online loan applications while minimizing the impact on your credit score. Remember, a proactive approach to managing your credit can help you achieve your financial goals while maintaining a healthy credit profile.

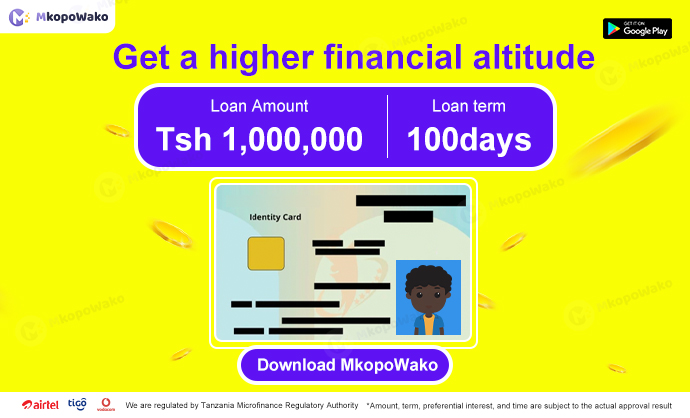

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status