How to improve your application success rate when applying for a loan online?

In today’s digital age, applying for a loan online has become a convenient and common practice. However, the success of your loan application depends on various factors that can impact the approval decision. To improve your chances of getting approved for a loan when applying online, there are several strategies you can implement to enhance your application and increase your approval rate.

1. Understand the Lender’s Requirements

Before applying for a loan online, it is crucial to carefully review and understand the lender’s requirements. Different lenders have varying criteria for approving loan applications, including credit score, income level, employment status, and debt-to-income ratio. By familiarizing yourself with these requirements, you can tailor your application to meet the lender’s expectations, thereby increasing your chances of approval.

2. Check and Improve Your Credit Score

One of the most critical factors that lenders consider when reviewing loan applications is the applicant’s credit score. A higher credit score indicates lower credit risk, making you a more attractive borrower in the eyes of lenders. Before applying for a loan online, check your credit score and take steps to improve it if necessary. Paying off outstanding debts, reducing credit card balances, and ensuring on-time bill payments can all help boost your credit score and increase your chances of loan approval.

3. Provide Accurate and Complete Information

When filling out an online loan application, it is essential to provide accurate and complete information to the best of your knowledge. Inaccurate or incomplete information can lead to delays in processing your application or even result in rejection. Double-check all the details provided, including personal information, financial documents, and employment history, to ensure everything is accurate and up-to-date.

4. Choose the Right Loan Type

There are various types of loans available online, each designed for specific purposes and borrower profiles. Before applying for a loan, research the different loan options available and choose the one that best suits your needs. Whether you’re looking for a personal loan, auto loan, student loan, or mortgage, selecting the right loan type increases your chances of approval and ensures you’re borrowing the right amount for your situation.

5. Review and Compare Multiple Lenders

To increase your chances of getting approved for a loan online, it’s essential to review and compare multiple lenders before submitting your application. Different lenders offer different terms, interest rates, and loan amounts, so it’s vital to shop around and find the lender that offers the most favorable conditions for your financial situation. Comparing multiple lenders gives you a better understanding of your options and helps you make an informed decision when choosing where to apply.

6. Seek Professional Advice

If you’re unsure about the loan application process or need assistance in improving your application, seeking professional advice can be beneficial. Financial advisors, loan officers, or credit counselors can provide guidance on how to strengthen your application and increase your chances of approval. Their expertise can help you navigate the loan application process effectively and address any concerns or questions you may have along the way.

Conclusion

Applying for a loan online can be a straightforward process if you take the necessary steps to increase your approval rate. By understanding the lender’s requirements, improving your credit score, providing accurate information, choosing the right loan type, comparing multiple lenders, and seeking professional advice, you can enhance your application and boost your chances of getting approved for the loan you need. Remember to approach the online loan application process strategically and be proactive in preparing a strong application to maximize your chances of success.

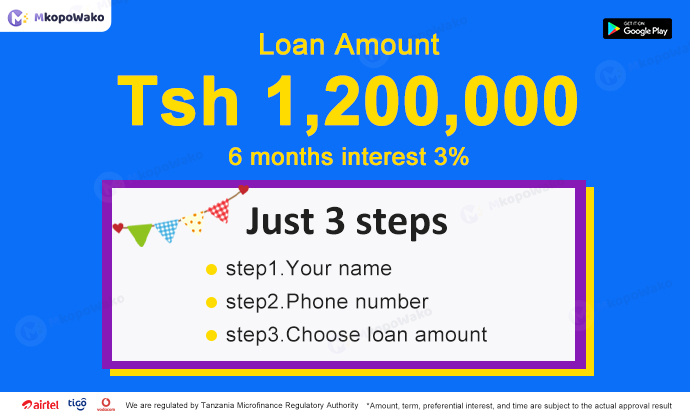

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status