Some Frequently Asked Questions about Applying for a Loan Online

In recent years, online loan applications have become increasingly popular due to their convenience and accessibility. However, many people still have questions and concerns about the process. In this article, we will provide answers to some of the most common questions about online loan applications.

What is an online loan application?

An online loan application is a process of applying for a loan through an internet-based platform. It eliminates the need for physical paperwork and allows borrowers to complete the entire process online. This includes submitting their personal and financial information, as well as signing the loan agreement electronically.

What are the advantages of applying for a loan online?

There are several advantages to applying for a loan online. Firstly, it saves time and effort by eliminating the need to visit a physical branch or fill out paperwork. Secondly, online loan applications can often be processed faster than traditional methods since everything is done digitally. Finally, online lenders may offer more competitive rates and terms than traditional lenders due to reduced overhead costs.

What information do I need to provide when applying for a loan online?

When applying for a loan online, borrowers typically need to provide personal information such as their name, address, social security number, and employment details. They also need to provide financial information such as their income, expenses, and credit score. Lenders may require additional documentation such as bank statements and pay stubs to verify the borrower’s financial status.

Is it safe to apply for a loan online?

Yes, it is generally safe to apply for a loan online. Reputable online lenders use secure technology to ensure that borrowers’ information is protected. It is important, however, to only use trusted websites and to avoid providing personal information on unsecured sites or to unknown lenders.

How long does it take to get approved for an online loan?

The time it takes to get approved for an online loan can vary depending on the lender and the borrower’s financial situation. Some lenders offer instant approval, while others may take several days to review the application. Once approved, the funds are typically deposited into the borrower’s account within a few business days.

What happens if I can’t make my loan payments?

If a borrower is unable to make their loan payments, they should contact their lender immediately to discuss their options. It is important to be honest and upfront about the situation as ignoring the problem can result in additional fees and damage to credit scores. Lenders may offer options such as deferment or forbearance to help borrowers manage their payments.

In conclusion, online loan applications offer a convenient and efficient way to apply for loans. By understanding the process and knowing what to expect, borrowers can make informed decisions when applying for loans online. Remember to always use trusted websites and lenders, provide accurate information, and communicate with the lender if any issues arise.

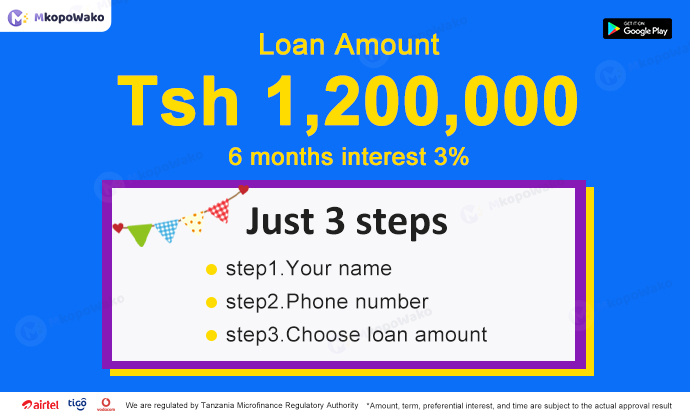

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status