How to apply for an online personal loan in Tanzania?

In today’s digital age, accessing financial services online has become more convenient than ever. In Tanzania, individuals in need of personal loans can now apply for them through various online platforms. This article will provide a comprehensive guide on how to apply for online personal loans in Tanzania, including the requirements, application process, and tips for a successful application.

Understanding Online Personal Loans

Online personal loans in Tanzania are a convenient way for individuals to access financing without having to visit a physical bank branch. These loans are typically unsecured, meaning they do not require collateral, and can be used for various purposes such as education, medical expenses, or business ventures. By utilizing online platforms, borrowers can streamline the application process, receive quick approvals, and access funds in a timely manner.

Requirements for Online Personal Loans

Before applying for an online personal loan in Tanzania, it is important to understand the common requirements set by lenders. Typically, applicants will need to provide proof of identity, such as a national ID or passport, proof of income, and bank statements. Additionally, some lenders may require applicants to have a good credit score to qualify for the loan. Understanding these requirements beforehand can help individuals prepare the necessary documentation for a smooth application process.

Applying for an Online Personal Loan

The application process for online personal loans in Tanzania usually begins by visiting the website of a reputable lender or financial institution. Once on the website, individuals can fill out an online application form, providing personal and financial information as required. It is crucial to ensure that the information provided is accurate and up-to-date to avoid any delays in the approval process. Additionally, applicants should carefully review the terms and conditions of the loan before submitting the application.

Tips for a Successful Application

To increase the chances of a successful loan application, individuals should consider several key tips. Firstly, maintaining a good credit history and a stable source of income can significantly improve the likelihood of loan approval. Additionally, providing all the required documentation and ensuring its accuracy is essential. It is also advisable to compare different lenders and their terms to find the most suitable option. Finally, being transparent and responsive during the application process can demonstrate reliability to the lender.

Receiving and Repaying the Loan

Upon approval of the online personal loan, the funds will be disbursed directly into the borrower’s bank account. It is important to carefully review the loan agreement, including the interest rate, repayment schedule, and any associated fees. Borrowers should create a feasible repayment plan to ensure timely payments, thus maintaining a positive credit history. Some lenders may offer flexible repayment options, and it is recommended to explore these features to manage the loan effectively.

Conclusion

In conclusion, applying for online personal loans in Tanzania offers a convenient and efficient way to access financing. By understanding the requirements, navigating the application process, and adhering to best practices, individuals can successfully obtain the funds they need. It is essential to conduct thorough research and choose reputable lenders to ensure a positive borrowing experience. With the increasing digitization of financial services, online personal loans provide a viable solution for individuals seeking quick and accessible funding.

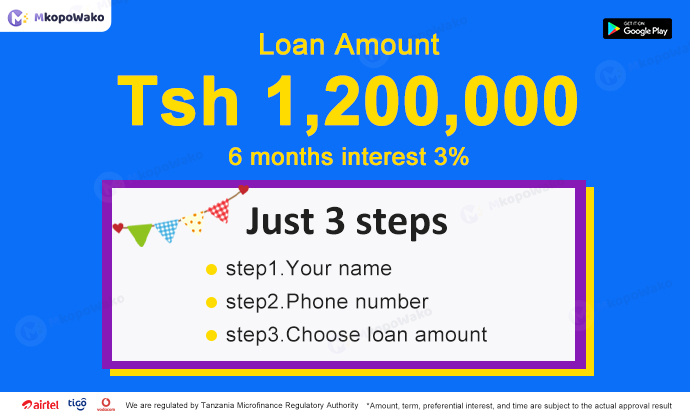

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status