How long does it take to get approved for an online loan in Tanzania?

Getting a loan used to be a lengthy and cumbersome process, but with the rise of online lending platforms, borrowers now have access to fast and convenient loan approval. In Tanzania, online loans have gained popularity due to their quick processing time and minimal documentation requirements. In this article, we will explore the approval time for online loans in Tanzania, providing a comprehensive overview of the process.

1. Introduction to Online Loans in Tanzania

Online loans have revolutionized the lending industry in Tanzania. These loans are provided by various financial institutions and lending platforms, which allow borrowers to apply for loans online through their websites or mobile applications. The online loan application process is simple and efficient, making it an attractive option for individuals seeking quick financing.

2. The Application Process

To apply for an online loan in Tanzania, borrowers need to visit the website or download the mobile application of a reputable lending platform. They will then be required to provide personal information, such as their name, address, employment details, and income. Additionally, borrowers may need to submit supporting documents, such as identification proof and bank statements, to verify their eligibility for the loan.

3. Loan Approval Time

The approval time for online loans in Tanzania can vary depending on the lending platform and the borrower’s profile. Generally, most online lenders aim to provide instant loan approval, with applicants receiving a decision within minutes of submitting their application. This is made possible by using advanced algorithms to assess the borrower’s creditworthiness and determine their repayment capacity.

4. Factors Affecting Approval Time

Several factors can influence the approval time for online loans in Tanzania. These include the completeness and accuracy of the borrower’s application, the verification process for supporting documents, and the lender’s internal policies and procedures. It is important for borrowers to ensure that they provide all the necessary information and documentation to expedite the approval process.

5. Additional Considerations

While online loans offer a quick and convenient financing option, borrowers should carefully consider the terms and conditions before committing to a loan. They should evaluate the interest rates, repayment terms, and any additional fees or charges associated with the loan. Comparing different lending platforms and reading customer reviews can help borrowers make an informed decision.

6. Conclusion

In conclusion, the approval time for online loans in Tanzania is typically quick, with most borrowers receiving a decision within minutes of applying. The simplicity and convenience of the online application process have made these loans increasingly popular among Tanzanians in need of fast financing. However, borrowers should exercise caution and thoroughly review the loan terms before proceeding with the loan. By doing so, they can ensure a smooth borrowing experience and avoid any potential pitfalls.

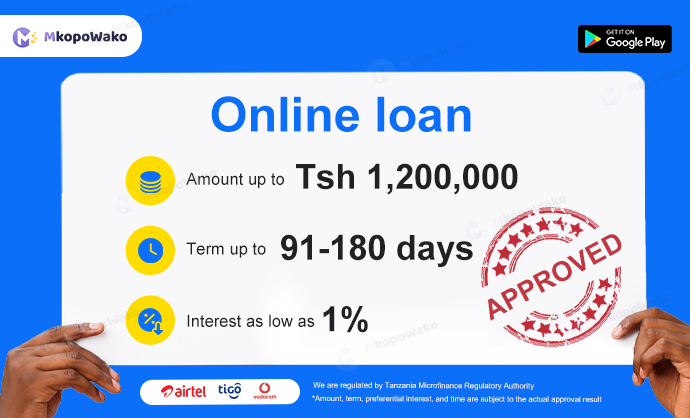

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status