What are the interest rates for online loans in Tanzania?

Tanzania’s financial sector has seen significant growth in recent years, with the rise of digital banking and online lending platforms providing more options for borrowers. Online lending has become particularly popular, as it allows borrowers to access funds quickly and conveniently, often with competitive interest rates.

In this article, we will provide an overview of the interest rates and loan products available through Tanzania’s online lending platforms.

Interest Rates

The interest rates offered by online lenders in Tanzania can vary widely depending on the lender and the type of loan product. Generally, interest rates for online loans in Tanzania range from 10% to 25%. However, some lenders may offer rates as low as 5% for certain loan products, while others may charge up to 30% or more.

It’s important to note that interest rates are not the only factor to consider when evaluating loan products. Other factors, such as fees, repayment terms, and loan amounts, can also significantly impact the overall cost of borrowing.

Loan Products

Online lenders in Tanzania offer a variety of loan products to meet the needs of different borrowers. These products include:

Personal Loans

Personal loans are unsecured loans that can be used for a variety of purposes, such as home improvements, education expenses, or medical bills. In Tanzania, personal loans typically range from TSH 10,000 to TSH 10,000,000, with repayment terms ranging from 3 to 24 months.

Business Loans

Business loans are designed to help entrepreneurs and small business owners access the capital they need to start or grow their businesses. These loans can be secured or unsecured and may be used for a variety of purposes, such as purchasing inventory, hiring employees, or expanding operations. Loan amounts for business loans in Tanzania typically range from TSH 1,000,000 to TSH 50,000,000, with repayment terms ranging from 3 to 36 months.

Payday Loans

Payday loans are short-term loans that are designed to help borrowers bridge the gap between paychecks. These loans typically have high interest rates and fees, and they are meant to be repaid in full on the borrower’s next payday. In Tanzania, payday loans typically range from TSH 50,000 to TSH 500,000.

Vehicle Loans

Vehicle loans are secured loans that can be used to purchase a new or used vehicle. In Tanzania, vehicle loans typically range from TSH 5,000,000 to TSH 100,000,000, with repayment terms ranging from 12 to 60 months.

Mortgage Loans

Mortgage loans are long-term loans that are used to finance the purchase of a home or other real estate. In Tanzania, mortgage loans typically range from TSH 50,000,000 to TSH 1,000,000,000, with repayment terms ranging from 5 to 30 years.

Conclusion

In conclusion, online lending has become an increasingly popular option for borrowers in Tanzania, offering quick and convenient access to funds at competitive interest rates. However, it’s important to carefully evaluate loan products and compare rates, fees, and other terms before making a decision. By doing so, borrowers can find the loan that best fits their needs and budget, while also avoiding potentially costly mistakes.

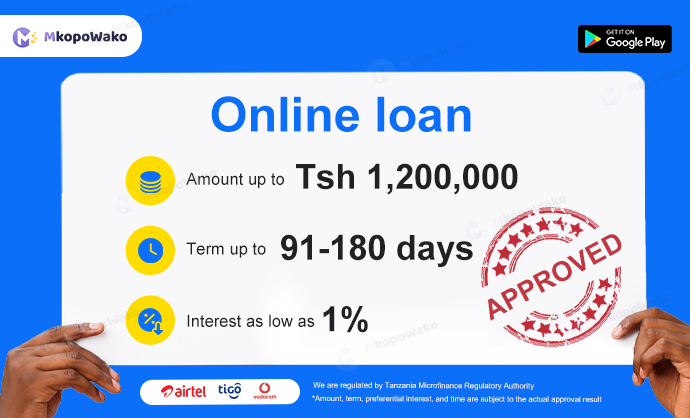

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status