What are the interest rates for unsecured quick loans?

The interest rate for unsecured quick loans varies depending on the lender and the borrower’s creditworthiness. In general, unsecured quick loans tend to have higher interest rates compared to secured loans due to the lack of collateral. These loans provide a fast and convenient way to access funds without having to put up assets as security. Let’s delve into the details of unsecured quick loans and explore the factors that influence their interest rates.

Understanding Unsecured Quick Loans

Unsecured quick loans are financial products that do not require collateral from the borrower. These loans are typically processed quickly, making them an attractive option for individuals in need of immediate funds. The approval process for unsecured quick loans is often based on the borrower’s credit score and income level, rather than the presence of collateral.

Factors Affecting Interest Rates

1. Credit Score: One of the primary factors influencing the interest rate of unsecured quick loans is the borrower’s credit score. Lenders consider credit scores as a measure of the borrower’s creditworthiness. A higher credit score usually translates to a lower interest rate, as it indicates a lower risk for the lender.

2. Income Level: Lenders also take into account the borrower’s income level when determining the interest rate for unsecured quick loans. A stable and sufficient income can positively impact the interest rate offered to the borrower, as it demonstrates the ability to repay the loan.

3. Loan Amount: The amount of the loan can also affect the interest rate. Higher loan amounts may come with higher interest rates to compensate for the increased risk taken on by the lender.

4. Loan Term: The length of the loan term can impact the interest rate as well. Shorter loan terms typically come with lower interest rates, while longer loan terms may have higher rates to account for the extended repayment period.

5. Market Conditions: Economic factors and market conditions can also influence interest rates for unsecured quick loans. Changes in interest rates set by central banks or fluctuations in the financial markets can impact the rates offered by lenders.

6. Lender Policies: Each lender may have specific policies and criteria that dictate the interest rates for unsecured quick loans. It’s essential for borrowers to compare offers from different lenders to find the most competitive rates.

Comparing Lenders and Offers

When seeking an unsecured quick loan, it’s crucial to compare multiple lenders and their offers. By obtaining quotes from different lenders, borrowers can assess the interest rates, fees, and terms to find the most suitable option for their financial needs. Online comparison tools and platforms can streamline this process and help borrowers make informed decisions.

Responsible Borrowing Practices

Before applying for an unsecured quick loan, borrowers should assess their financial situation and ensure they can comfortably repay the loan. It’s essential to borrow responsibly and avoid taking on more debt than necessary. Creating a budget and repayment plan can help borrowers manage their finances effectively and avoid falling into a cycle of debt.

Conclusion

In conclusion, the interest rate for unsecured quick loans is influenced by various factors, including the borrower’s credit score, income level, loan amount, term, market conditions, and lender policies. Borrowers should carefully evaluate these factors and compare offers from different lenders to secure the most favorable terms. By borrowing responsibly and managing finances prudently, individuals can benefit from the convenience of unsecured quick loans while maintaining financial stability.

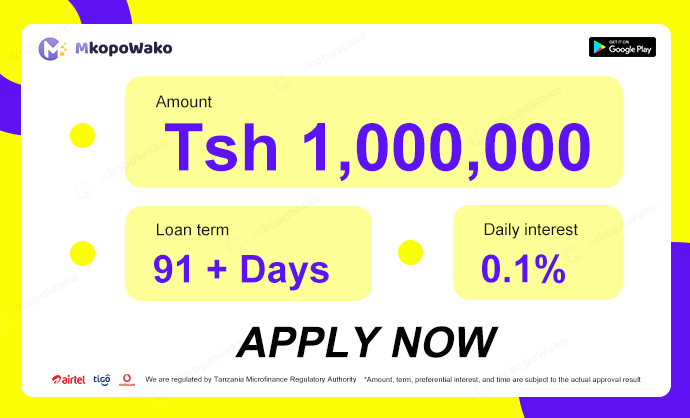

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status