What are the interest rates for online loans in Tanzania?

In recent years, online lending has gained popularity in Tanzania as a quick and convenient way for individuals and businesses to access financial assistance. With the rise of digital platforms, borrowers can now apply for loans online and receive funds within a short period. However, it is important to understand the interest rates associated with online loans in Tanzania before making a decision. This article aims to provide a comprehensive overview of online loan interest rates in Tanzania, ensuring that you are well-informed before borrowing.

1. Understanding Online Loans in Tanzania

Online loans refer to the process of borrowing money through digital platforms, eliminating the need for traditional brick-and-mortar institutions. These loans offer various advantages, such as faster approval times, flexible repayment options, and convenience. However, it is crucial to consider the interest rates that come with these loans to avoid falling into a debt trap.

2. Factors Affecting Online Loan Interest Rates

Several factors contribute to the determination of online loan interest rates in Tanzania. These factors include:

1. Credit score: Lenders often consider credit scores to assess the borrower’s creditworthiness. A higher credit score may result in lower interest rates.

2. Loan amount and duration: The loan amount and repayment period can impact the interest rates. Generally, larger loan amounts or longer durations may attract higher interest rates.

3. Collateral: Some online lenders require collateral for certain loan types. The presence of collateral may reduce the interest rates.

4. Market conditions: Economic factors and market conditions can influence interest rates. During periods of economic stability, interest rates may be lower compared to times of uncertainty.

3. Typical Interest Rates for Online Loans in Tanzania

The interest rates for online loans in Tanzania can vary depending on the lender and loan type. Generally, these rates range from 10% to 30% per annum. However, it is important to note that some lenders may charge higher rates for riskier loans or borrowers with lower credit scores.

4. Comparing Online Loan Providers in Tanzania

When considering online loans in Tanzania, it is advisable to compare different lenders and their interest rates before making a decision. This can be done by researching online, reading customer reviews, and comparing terms and conditions. By doing thorough research, you can find a lender that offers competitive interest rates and favorable loan terms.

5. The Importance of Responsible Borrowing

While online loans can provide financial assistance when needed, it is crucial to practice responsible borrowing. Borrowers should only take out loans they can afford to repay and avoid excessive borrowing. Understanding the repayment terms and interest rates is essential to ensure that the loan does not become a burden.

6. Conclusion

In conclusion, online lending has become a popular option for individuals and businesses seeking quick access to funds in Tanzania. When considering online loans, it is important to evaluate the interest rates associated with these loans to make an informed decision. Factors such as credit score, loan amount, duration, collateral, and market conditions can influence the interest rates offered by online lenders. By comparing different providers and practicing responsible borrowing, borrowers can secure loans with competitive rates and favorable terms.

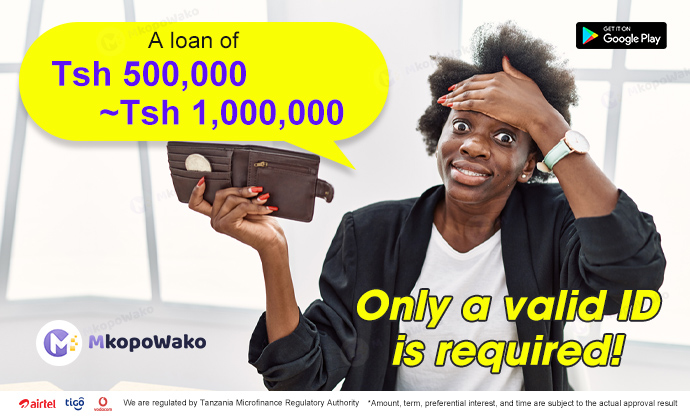

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status