What is the interest rate for needing a quick loan in Tanzania?

In Tanzania, what is the interest rate for quick loans? This is a question that many people are concerned about because the interest rate directly affects the borrowing cost for individuals and businesses. In this article, we will delve into the situation of loan interest rates in Tanzania, including different types of loan products, interest rate levels, application procedures, and more, to help readers better understand Tanzania’s loan market. Whether you are an individual or a business looking to achieve financial goals through loans, this article will provide valuable information.

Types of Loan Products

Tanzania’s loan market covers a variety of loan products, including personal consumer loans, housing loans, vehicle loans, business operation loans, and more. Each type of loan product has its specific purposes and conditions tailored to different groups of borrowers. Personal consumer loans are typically used for daily expenses or large purchases, while housing loans are for purchasing or renovating homes. Vehicle loans are for purchasing vehicles, and business operation loans are meant to support the development and expansion of businesses.

Interest Rate Level

The interest rate level for loans in Tanzania is relatively high, mainly influenced by various factors such as macroeconomic conditions, monetary policies, and market competition. Generally, the interest rate for personal consumer loans is higher than that for housing loans and business loans, as the former carries greater risk, while the latter usually have collateral or business plans as support. Due to the relatively unstable economic environment in Tanzania, loan interest rates may fluctuate, and borrowers need to closely monitor market trends.

Application Procedure

Applying for a loan typically requires borrowers to provide basic personal or business information, income proof, asset proof, and undergo credit assessment and review. The application process and conditions vary for different loan products. Personal consumer loans may focus more on personal credit records and income situations, while business loans will pay attention to the business’s operations and prospects. When applying for a loan, borrowers need to prepare relevant documents adequately and maintain good communication with loan institutions to increase the chances of a successful application.

Impact of Loan Interest Rates

The level of loan interest rates directly affects the borrowing costs for individuals and businesses, with significant implications for economic development and people’s well-being. High-interest rates may increase the burden on borrowers, making repayment difficult, and putting pressure on businesses’ operations and investments. Therefore, the government and financial regulatory authorities need to maintain the stability of the loan market through reasonable policies and regulatory measures to ensure that loan interest rates are at a reasonable level.

Future Trends in the Loan Market

As Tanzania’s economy develops and the financial market improves, the loan market will also encounter new opportunities and challenges. The government is increasing the inclusiveness of financial services, encouraging innovation and application of financial technology to enhance financial inclusion and service efficiency. In the future, Tanzania’s loan market will become more diverse and convenient, providing borrowers with more choices and higher-quality services.

Summary and Conclusion

In Tanzania, the interest rate for quick loans is influenced by various factors, and borrowers need to select suitable loan products and institutions based on their needs and circumstances. At the same time, the government and financial regulatory authorities need to actively guide and regulate the loan market to ensure that loan interest rates are at a reasonable level, promoting stable economic development and improving people’s livelihoods.

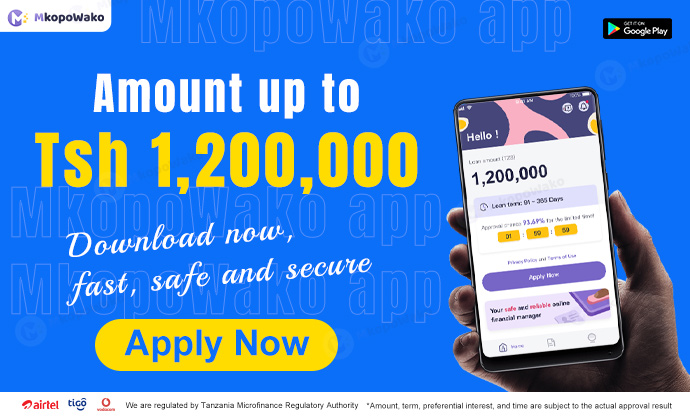

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status