Will loan application affect my credit score?

When applying for a loan, many people wonder whether it will affect their credit score. Understanding the impact of loan applications on credit scores is crucial for maintaining good financial health. Let’s delve into this topic to uncover the relationship between loan applications and credit scores, providing you with valuable insights to make informed financial decisions.

1. How Loan Applications Affect Credit Scores

Submitting a loan application typically triggers a hard inquiry on your credit report. This hard inquiry can cause a temporary dip in your credit score. However, the impact is usually minimal and short-lived. It’s important to note that multiple loan applications within a short period can have a cumulative negative effect on your credit score.

2. Types of Credit Inquiries

There are two types of credit inquiries: hard inquiries and soft inquiries. Hard inquiries, generated by loan applications, can impact your credit score. On the other hand, soft inquiries, such as background checks or pre-approved offers, do not affect your credit score. Understanding the distinction between these two types is essential when monitoring your credit health.

3. Managing Multiple Loan Applications

Applying for multiple loans simultaneously may raise red flags to lenders and negatively impact your credit score. It is advisable to space out your loan applications and only apply for credit when necessary. Additionally, comparing loan offers from different lenders within a short period is considered as rate shopping and typically treated as a single inquiry for credit scoring purposes.

4. Long-Term Impact on Credit Score

While a single loan application may lead to a temporary decrease in your credit score, responsible repayment behavior can help improve your credit over time. Making timely payments on your loans and managing your overall debt responsibly are key factors in maintaining a healthy credit score. Demonstrating financial stability and reliability to lenders can positively influence your creditworthiness.

5. Monitoring Your Credit Report

Regularly monitoring your credit report is essential for detecting any inaccuracies or unauthorized inquiries that could potentially harm your credit score. By staying informed about the information contained in your credit report, you can take proactive steps to address any issues promptly and safeguard your credit health.

6. Conclusion: Balancing Loan Applications and Credit Health

In conclusion, while loan applications may have a temporary impact on your credit score, responsible borrowing and repayment practices play a more significant role in determining your overall credit health. By understanding how loan applications affect your credit score and taking proactive steps to manage your finances wisely, you can maintain a strong credit profile and achieve your financial goals. Remember, knowledge is power when it comes to navigating the complexities of credit and loans.

With these insights in mind, you can approach loan applications strategically, balancing your financial needs with the maintenance of a healthy credit score. Stay informed, be proactive, and make informed decisions to secure a stable financial future.

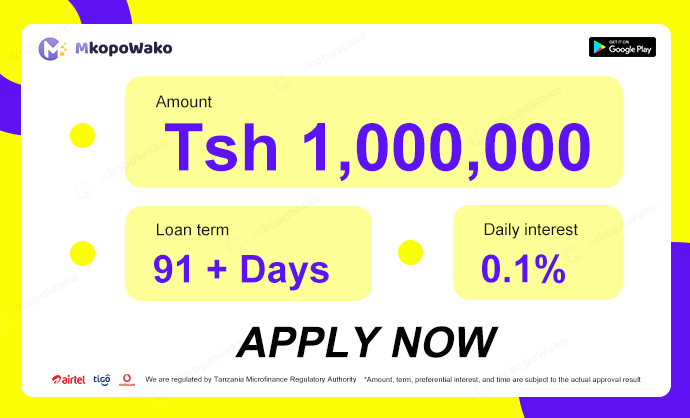

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status