How to start an online loan application?

In today’s digital age, applying for a loan online has become a convenient and streamlined process. Whether you need funds for unexpected expenses, a home renovation project, or debt consolidation, online loans offer a quick solution with easy access to financial assistance. However, navigating the online lending landscape can be overwhelming for some. This comprehensive guide will walk you through the steps to successfully apply for an online loan, outlining the key factors to consider and providing tips for a smooth application process.

Understanding Your Financial Needs and Options

Before diving into the online loan application process, it’s crucial to assess your financial situation and determine your specific borrowing needs. Consider how much money you require, the purpose of the loan, and your ability to repay the borrowed amount. Additionally, research different types of loans available online, such as personal loans, payday loans, or installment loans, to find the most suitable option for your circumstances.

Researching and Comparing Lenders

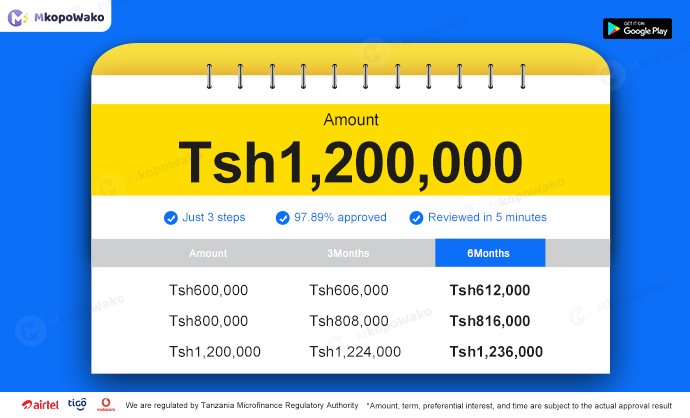

Once you have a clear understanding of your financial needs, start researching reputable online lenders. Look for lenders that are transparent about their terms and fees, have positive customer reviews, and offer competitive interest rates. Compare loan offers from multiple lenders to ensure you are getting the best deal possible. Pay close attention to factors like APR, repayment terms, and any additional fees associated with the loan.

Checking Your Eligibility and Gather Required Documents

Before applying for an online loan, check the eligibility requirements set by the lender. Typically, you will need to provide proof of income, identification documents, and other personal information. Make sure you have all the necessary documents ready to streamline the application process and prevent any delays in approval. Meeting the lender’s eligibility criteria will increase your chances of securing the loan.

Completing the Online Application

Once you have selected a lender and gathered all the required documents, it’s time to complete the online application form. Provide accurate information and double-check all details before submitting the application. Inaccurate or incomplete information can lead to delays in processing your loan request. Be prepared to disclose details about your income, employment status, credit history, and any existing debts during the application process.

Reviewing and Accepting the Loan Offer

After submitting your application, the lender will review your information and make a decision regarding your loan request. If approved, you will receive a loan offer outlining the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any applicable fees. Take the time to carefully review the offer and make sure you understand all the terms before accepting the loan.

Receiving Funds and Repaying the Loan

Once you have accepted the loan offer, the funds will be disbursed to your bank account within a few business days. Make sure to use the funds responsibly and adhere to the agreed-upon repayment schedule. Timely repayment of the loan will not only help you maintain a good credit score but also establish a positive relationship with the lender for future financial needs.

Conclusion

Applying for an online loan can provide a convenient solution to your financial needs, but it’s essential to approach the process thoughtfully and responsibly. By understanding your financial requirements, researching lenders, and carefully reviewing loan terms, you can navigate the online lending landscape with confidence. Remember to borrow only what you need and can afford to repay to avoid falling into a cycle of debt. With proper planning and consideration, online loans can be a valuable tool to help you achieve your financial goals.

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status