Loan types and application conditions for online loan application

With the rapid development of the Internet, online loans have become more and more popular. Compared with traditional bank loans, online loans have the advantages of convenience, fast approval, and flexible repayment terms. In this article, we will introduce several common types of online loans and their application requirements.

Personal Loans

Personal loans are one of the most common types of online loans. They are usually used for personal expenses such as medical bills, home improvement, or debt consolidation. To apply for a personal loan online, you need to provide personal information such as your name, address, income, and employment status. In addition, you may need to submit documents such as tax returns or bank statements to prove your creditworthiness.

Business Loans

Online business loans are designed for small businesses that need financing for expansion, inventory, or equipment purchase. The application process is similar to personal loans, but you need to provide additional information about your business, such as your business plan, financial statements, and tax returns. Your business credit score and revenue will also be evaluated by the lender to determine your eligibility for the loan.

Payday Loans

Payday loans are short-term loans that are usually used to cover unexpected expenses such as car repairs or medical bills. The application process is simple and fast, and you can get the money within a few hours. However, payday loans have high-interest rates and fees, so they should only be used as a last resort.

Installment Loans

Installment loans are loans that are repaid in equal installments over a period of time. They can be used for various purposes such as home renovation, education, or debt consolidation. To qualify for an installment loan, you need to have a stable income and good credit history. Some lenders may also require collateral such as a car or a house.

Home Equity Loans

Home equity loans are loans that allow you to borrow money against the value of your home. They are usually used for home improvement, debt consolidation, or major purchases. To apply for a home equity loan online, you need to provide information about your home’s value, mortgage balance, and income. You also need to have a good credit score and a low debt-to-income ratio.

Auto Loans

Auto loans are loans that are used to finance the purchase of a car. They can be secured or unsecured, depending on the lender’s requirements. To apply for an auto loan online, you need to provide information about the car you want to buy, your income, and your credit history. The lender will evaluate your application and determine the interest rate and repayment terms based on your creditworthiness.

In conclusion, online loans provide a convenient and fast way to borrow money. However, before applying for a loan, you should carefully consider your financial situation and choose the type of loan that best suits your needs. Remember to read the terms and conditions carefully and compare different lenders to find the best deal.

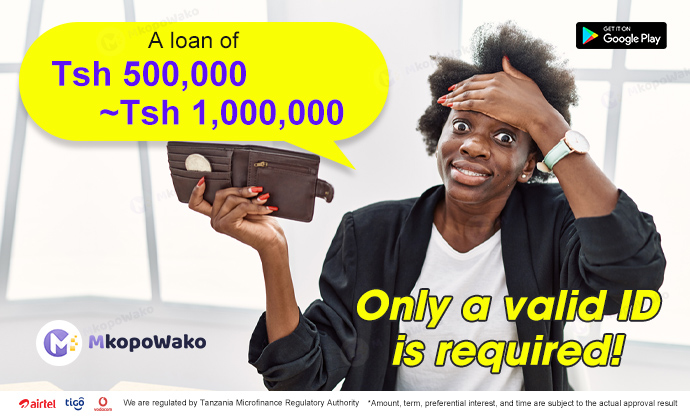

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status