Do online loans in Tanzania offer flexible repayment options?

In today’s fast-paced life, people are increasingly relying on online loans to meet their financial needs. As one of the fastest growing economies on the African continent, Tanzania has also followed the global trend in providing online loan services. When choosing an online loan platform, many borrowers focus on whether it offers flexible repayment options. This article will detail whether online loans in Tanzania offer flexible repayment options, as well as the specifics and benefits of these options.

Flexible repayment cycle

Online loan platforms in Tanzania often offer flexible repayment periods to meet the needs of different borrowers. This means that borrowers can choose a suitable repayment cycle based on their income and repayment ability, such as monthly, fortnightly or weekly. This flexibility allows borrowers to better plan their finances and avoid situations where repayment stress is excessive.

Various repayment methods

In addition to flexible repayment cycles, Tanzania online loan platforms usually offer a variety of repayment methods, including bank transfers, mobile payments and cash deposits. This way, borrowers can choose the most suitable repayment method based on their preferences and convenience, making loan repayments more convenient.

Early repayment options

Another important flexible repayment option is the early repayment option. Online loan platforms in Tanzania often allow borrowers to pay off their loans early without paying additional fees. This gives borrowers more options and flexibility to get out of debt earlier based on their financial situation, while also reducing interest payments.

Delayed repayment arrangement

In some cases, borrowers may face short-term cash flow difficulties and be unable to complete loan repayments on time. In response to this situation, Tanzania online loan platforms usually also provide flexible delayed repayment arrangements. Borrowers can negotiate with their lenders the time and conditions for deferring repayments to relieve temporary financial pressure while avoiding overdue penalties and damage to their credit history.

Self-service repayment management

In order to facilitate borrowers to manage repayment matters, Tanzania online loan platforms usually provide self-service repayment management functions. Borrowers can easily check loan balances, repayment plans and history through mobile applications or websites, and perform repayment operations anytime and anywhere, improving the convenience and efficiency of repayment.

Summary

In short, online loan platforms in Tanzania usually provide a variety of flexible repayment options, including flexible repayment cycles, multiple repayment methods, early repayment options, delayed repayment arrangements and self-service repayment management, etc. Meet the different financial needs and repayment abilities of borrowers. These flexible repayment options give borrowers more choice and control while reducing the stress and inconvenience that can arise during the repayment process. Therefore, borrowers can be assured of these flexible repayment services when choosing an online loan platform in Tanzania.

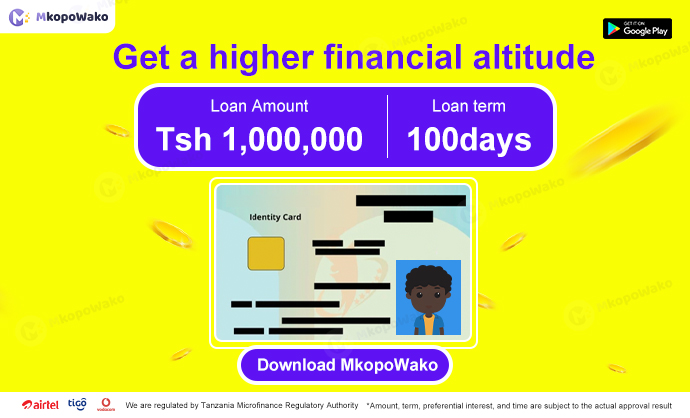

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status