What is the repayment period for an online personal loan in Tanzania?

In Tanzania, what is the repayment period for online personal loans? Let’s delve into this topic and explore the ins and outs of the repayment terms for personal loans obtained through online platforms in Tanzania.

Understanding Online Personal Loans in Tanzania

Online personal loans have become increasingly popular in Tanzania due to their convenience and accessibility. These loans provide individuals with quick access to funds without the need to visit a physical bank branch. However, it is essential to understand the repayment terms associated with these loans to ensure timely and hassle-free repayment.

Repayment Period for Online Personal Loans

In Tanzania, the repayment period for online personal loans typically ranges from 1 month to 12 months, depending on the lender and the amount borrowed. Short-term loans usually have a repayment period of 1 to 3 months, while long-term loans can extend up to 12 months or more. Borrowers can select a repayment term that aligns with their financial situation and ability to repay the loan.

Factors Influencing the Repayment Period

Several factors can influence the repayment period for online personal loans in Tanzania. These factors include the loan amount, interest rate, borrower’s income, and credit history. Lenders may assess these factors to determine the appropriate repayment period for each borrower. It is crucial for borrowers to communicate with the lender regarding their preferences and financial capabilities to establish a suitable repayment plan.

Flexible Repayment Options

Many online lenders in Tanzania offer flexible repayment options to accommodate borrowers’ needs. These options may include monthly installments, bi-weekly payments, or custom payment schedules. Borrowers can discuss their preferences with the lender and choose a repayment plan that works best for them. It is essential to adhere to the agreed-upon repayment schedule to avoid any penalties or late fees.

Managing Repayments Effectively

To manage repayments effectively, borrowers should create a budget that includes loan repayments as a priority expense. By tracking income and expenses, borrowers can ensure they have sufficient funds to meet their repayment obligations. Additionally, setting up automatic payments or reminders can help borrowers stay on track with their repayments and avoid any missed payments.

Conclusion

In conclusion, the repayment period for online personal loans in Tanzania varies depending on the lender and the loan terms. Borrowers should carefully review the repayment terms before accepting a loan offer and choose a repayment period that suits their financial situation. Effective management of repayments is crucial to maintaining a positive credit history and avoiding any financial difficulties. By understanding the repayment terms and communicating with the lender, borrowers can navigate the loan repayment process successfully.

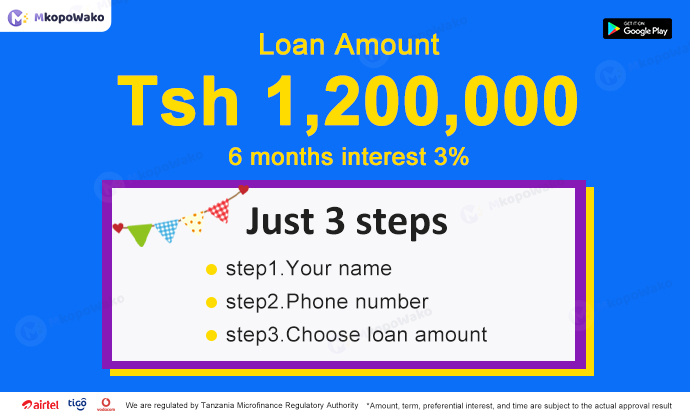

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status