How safe are online loans in Tanzania?

Online lending has become increasingly popular in Tanzania, providing individuals and businesses with convenient access to quick financial assistance. However, with the rise of online lending platforms, concerns about the security of these services have also emerged. Ensuring the safety and security of online loans in Tanzania is crucial to protect borrowers from fraud and potential financial risks. In this article, we will explore the various measures put in place to safeguard the security of online loans in Tanzania.

1. Regulatory Framework

Regulatory Measures

One of the key factors in ensuring the safety of online lending in Tanzania is the regulatory framework that governs the industry. The Bank of Tanzania (BOT) plays a significant role in overseeing and regulating financial institutions, including online lenders. By setting guidelines and regulations for online lending platforms, the BOT helps ensure that borrowers are protected from unfair practices and fraudulent activities.

2. Licensing Requirements

Licensing Compliance

Online lending platforms in Tanzania are required to obtain the necessary licenses and approvals from the relevant regulatory authorities before they can operate. By adhering to licensing requirements, online lenders demonstrate their commitment to operating within legal boundaries and upholding industry standards. Borrowers can feel more secure knowing that the online platform they are using is authorized and compliant with regulatory requirements.

3. Data Security Measures

Data Protection

Protecting the personal and financial information of borrowers is paramount in online lending. Lenders in Tanzania implement robust data security measures to safeguard sensitive data from unauthorized access or cyber threats. Encryption technologies, secure servers, and strict data protection protocols are commonly used to ensure the confidentiality and integrity of borrower information.

4. Transparent Terms and Conditions

Clarity in Terms

Transparent and easily understandable terms and conditions are essential in promoting trust and confidence among borrowers. Online lending platforms in Tanzania are required to disclose all relevant information regarding loan terms, interest rates, fees, and repayment schedules upfront. By providing clear and concise details, borrowers can make informed decisions and avoid any hidden surprises or deceptive practices.

5. Customer Support and Redress Mechanisms

Support Services

Effective customer support and redress mechanisms are vital components of a secure online lending environment. Borrowers should have access to prompt assistance and resolution in case of any issues or disputes. Online lenders in Tanzania often provide multiple channels for customer support, such as phone, email, and live chat, to address borrower concerns and ensure a positive borrowing experience.

6. Credit Risk Assessment

Risk Management

Conducting thorough credit risk assessments is crucial for responsible lending practices. Online lenders in Tanzania utilize advanced algorithms and data analytics to evaluate the creditworthiness of applicants and determine their ability to repay the loan. By assessing credit risk accurately, lenders can mitigate the likelihood of default and ensure sustainable lending practices.

In conclusion, the security of online loans in Tanzania is upheld through a combination of regulatory oversight, licensing compliance, data security measures, transparent terms and conditions, customer support services, and credit risk assessment practices. By prioritizing the safety and protection of borrowers, online lending platforms contribute to a more trustworthy and reliable financial ecosystem in Tanzania.

—

Summary

Final Thoughts

Ensuring the security of online loans in Tanzania is a multifaceted process that involves regulatory supervision, technological safeguards, transparency, customer support, and risk management. By implementing these comprehensive security measures, online lending platforms can foster trust and confidence among borrowers and promote responsible financial practices in the digital age.

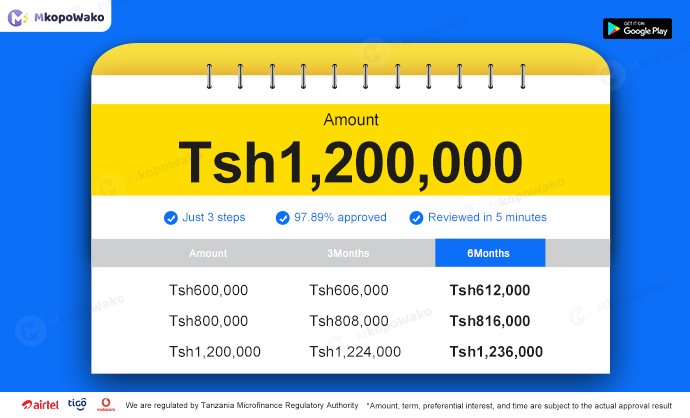

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status

MkopoWako - Online Cash Loan

5.0 (1 million +)

Security Status